- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - MPF System approaches its 21st anniversary MPFA makes every effort to move forward with reforms

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - MPF System approaches its 21st anniversary MPFA makes every effort to move forward with reforms

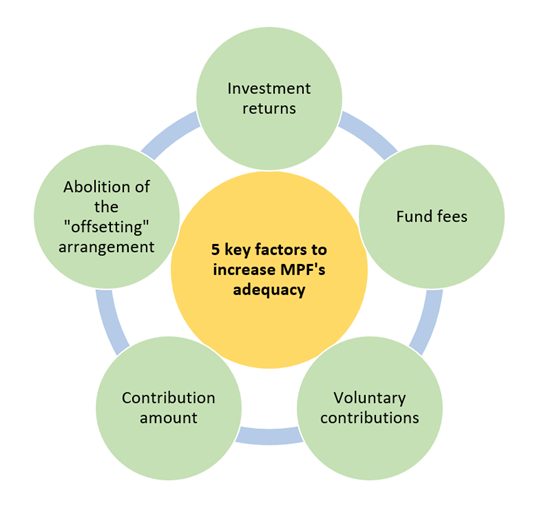

MPFA Chairman Mrs Ayesha Macpherson Lau today (28 November) published a blog post, in which she pointed out that the MPF System is approaching its 21st anniversary, which marks the beginning of its journey towards maturity. She stressed that since its implementation, the MPF System has been developing according to its original intent, making a number of achievements, and the MPFA will focus on continuous improvement of the MPF System in the future, with a view to enhancing its efficiency and adequacy. Mrs Lau explained enhancing the adequacy of MPF hinges on five key factors, namely investment returns, fund fees, contribution amounts, abolition of the “offsetting” arrangement, and voluntary contributions.

With regard to investment returns, Mrs Lau pointed out that the annualized net return of MPF since its inception was 4.4% as at the end of September 2021, higher than the inflation rate of 1.6% over the same period, reflecting the continuous steady growth of the MPF System. The MPFA will continue to study different measures to broaden the range of MPF investments in order to assist the working population to seize investment opportunities and make effective asset allocations. Mrs Lau also revealed that the MPFA has been reviewing the existing MPF fund choices and urged the industry to explore diverse retirement investment solutions based on returns expected by scheme members.

Mrs Lau mentioned that the MPFA has facilitated fee reductions through different measures over the years, including enhancing the transparency of MPF fund fees, providing tools for fee comparisons, and introducing the Employee Choice Arrangement and Default Investment Strategy to foster market competition. The average fund expense ratio of MPF funds has dropped by 30%, from 2.1% in 2007 to the current level of 1.43%. To further create room for fee reductions, the MPFA is working at full steam on the construction of the eMPF Platform, which will operate on a cost recovery basis, such that MPF scheme members can benefit directly from the savings in administration cost.

In addition, the minimum and maximum relevant income levels of MPF contributions have to be adjusted in a timely manner to ensure the adequacy of MPF. Mrs Lau said that the Government will pay MPF contributions for low-income workers after the eMPF Platform has come into full operation, which will enable grassroots workers to have monthly contributions of 10%. Furthermore, she pointed out that the Government has announced it will make legislative amendment to abolish the MPF “offsetting” arrangement in the next legislative session, allowing the working population to accumulate more MPF assets in the long run.

Mrs Lau believed that voluntary contributions could strengthen retirement protection for the working population and pointed out that the total amount of Tax-deductible Voluntary Contributions (TVC) amounted to $2.2 billion in financial year 2020-2021, representing a year-on-year growth of 30%. The figures reflected that more and more scheme members recognize the importance of enhancing retirement savings through voluntary contributions.

As the MPF System approaches its 21st anniversary, under the premise of protecting employees’ MPF benefits, Mrs Lau will continue to lead the MPFA moving forward and making timely reforms to the MPF System for building a solid foundation for basic retirement protection of the Hong Kong working population.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

28 November 2021