- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - MPFA strives to ensure MPF value for money

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - MPFA strives to ensure MPF value for money

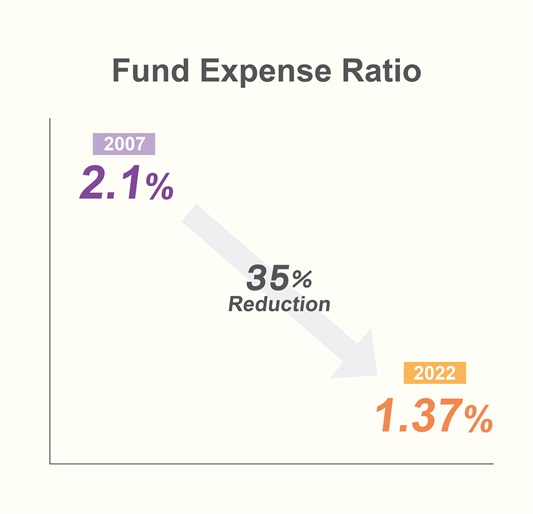

In her latest blog post, published today (25 September), MPFA Chairman Mrs Ayesha Macpherson Lau said that consistently driving fee reductions has always been one of the top priorities of the MPFA. As a result of the joint efforts of the MPFA and the industry, the fund expense ratio (FER), an objective measurement of MPF fee levels, dropped from 2.1% in 2007 to the current 1.37%, a decrease of 35% (see Image 1).

(Image 1)

Mrs Lau mentioned that the MPF fees are composed mainly of administration fees, investment management fees, custodian fees and trustee fees, with administration fees accounting for over 40% of the FER. Regarding administration fees, the eMPF Platform, which the MPFA is currently constructing at full steam, will standardize, streamline and automate the administration processes, aiming for as much as a 55% reduction in the administration fees of MPF funds.

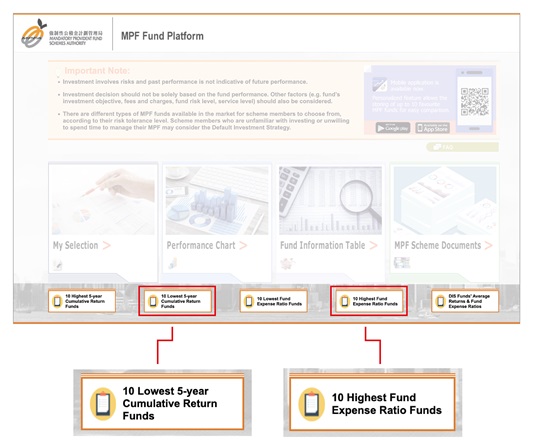

As for other fees, the MPFA will continue to enhance the transparency of the MPF to foster market competition, leading to fee reductions. The MPF Fund Platform on the MPFA website introduced two more “top ten lists” last month, namely the “10 Lowest 5-year Cumulative Return Funds” and the “10 Highest Fund Expense Ratio Funds”, together with the existing “10 Highest 5-year Cumulative Return Funds” and the “10 Lowest Fund Expense Ratio Funds” lists, to help scheme members compare the returns and fees of different funds more conveniently, thus encouraging them to manage their MPF proactively and prepare for retirement protection in the future (see Image 2).

(Image 2: The MPFA added two more lists to the MPF Fund Platform in August this year (shown in the red boxes): “10 Lowest 5-year Cumulative Return Funds” and “10 Highest Fund Expense Ratio Funds”.)

Mrs Lau suggested that scheme members should not only compare fees, but also consider the value for money of each fund. If a fund charges a higher fee but achieves better results through more active management, it might be worth the cost compared to a fund with lower fees but lower returns.

She pointed out that after administration fees, investment management fees are the second-largest component of the FER, accounting for over one third of the FER. MPF trustees are responsible for investment governance reporting of their MPF schemes to scheme members, and explaining how they discharge their related duties, including how they appoint investment managers and how they monitor investment management fee levels. The MPFA requested MPF trustees to start preparing annual governance reports to conduct and disclose value-for-money assessment of their MPF schemes and follow-up action. MPF trustees are required to submit the governance report to the MPFA and upload them to their websites as early as 2023 Q2 to help scheme members better understand whether their fund choice offers value for money.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

25 September 2022