- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - The design of MPF System helps diversify risks

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - The design of MPF System helps diversify risks

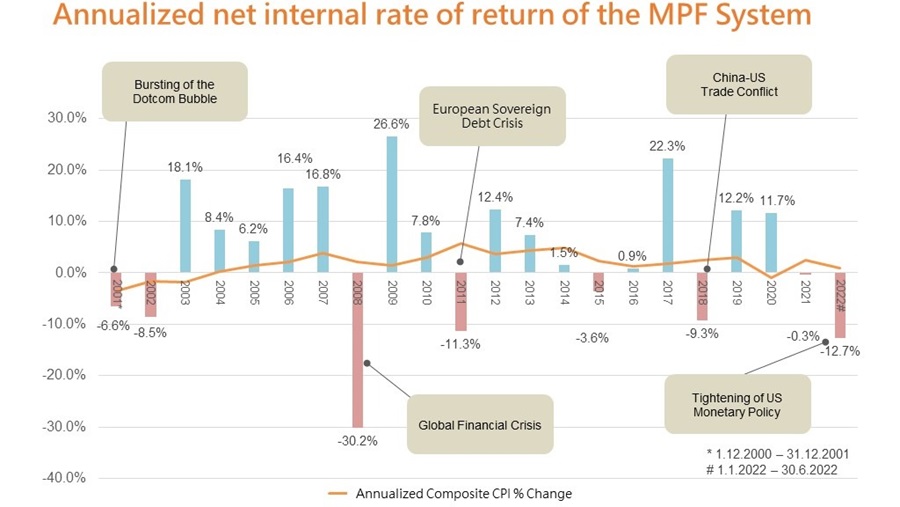

In her latest blog post, published today (27 November), MPFA Chairman Mrs Ayesha Macpherson Lau said that the MPF System has been implemented for almost 22 years since its inception on 1 December 2000. A number of reforms were introduced to enhance the System throughout the years. Yet, as a retirement protection system, it is still at its developing stage towards maturity. MPF is a very long-term investment, hence MPF scheme members should not treat it with a short-term speculative perspective. In fact, over the past nearly 22 years since its inception, the MPF System has gone through various economic cycles and financial market fluctuations, with positive returns recorded in 14 years, and there were normally rebounds after those years with negative returns.

#As the period covered is less than a year, the figure reflects only the net internal rate of return during the relevant period.

(Image 1)

Mrs Lau pointed out that the design of the MPF System has three key advantages, namely dollar-cost averaging, diversified investment and default investment strategy (DIS). With dollar-cost averaging, MPF scheme members need not predict the best timing to enter the market or try to time the market while investing a fixed amount regularly. Long-term and regular investment helps average out the costs of fund units, thus mitigating the impact of short-term market fluctuations on their investment and eventually adding value to their retirement reserves.

She reiterated that the current short-term performance of MPF does not represent MPF performance over the whole investment period of scheme members, so scheme members should not be overly concerned with market fluctuations. Switching MPF funds after a significant drop in the market can easily lead to a situation of "buying high, selling low", turning short-term fluctuations into actual investment losses.

In addition, of the total MPF assets, about 44% are invested in equity funds, and 35% are invested in mixed assets funds (funds that invest primarily in bonds and equities). These two types of funds account for almost 80% of total MPF assets. Hence, market fluctuations will have a significant impact on the overall return of the MPF, but in the long term, all fund types have recorded positive returns. Since the inception of the MPF System, equity funds and mixed assets funds have recorded a cumulative net return of about 1.4 times and 1.2 times respectively, indicating that the MPF can perform the function of capital appreciation by rolling over the principal through long-term investment.

(Image 2)

Mrs Lau urged scheme members to review their MPF investment portfolio regularly and take into consideration factors such as their stage of life, risk-tolerance level and personal investment goals when allocating their investment portfolio. They should also bear in mind that investment diversification can effectively reduce investment risk compared to concentrating their investment in a single market or asset type.

Scheme members who are unfamiliar with investing or have no time to manage their MPF can consider choosing the DIS, which adopts a diversified investment approach by investing in global equities and bond markets, coupled with the feature of “automatic de-risking”, which can effectively reduce risk and is subject to fee cap. It is a ready-made investment strategy that deserves scheme members’ consideration.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

27 November 2022