- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - TVC adds value to your retirement reserves

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - TVC adds value to your retirement reserves

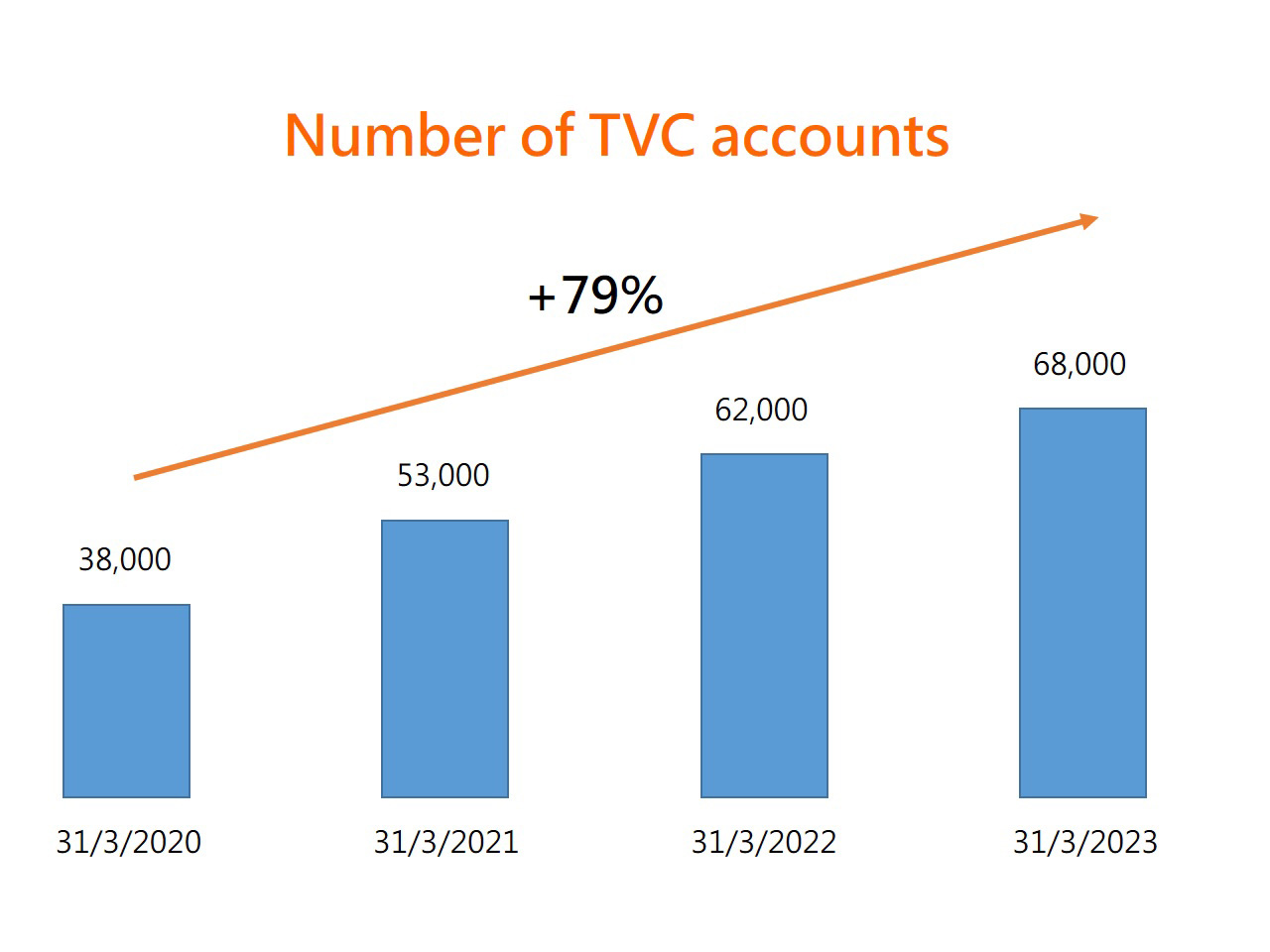

MPFA Chairman Mrs Ayesha Macpherson Lau published her latest blog post today (28 May), highlighting that Tax-deductible Voluntary Contributions (TVC) has been in place for 4 years and that the number of TVC accounts has been steadily increasing, which demonstrates the growing awareness about planning early for retirement protection through TVC. As at 31 March 2023, there were about 68,000 TVC accounts, representing a year-on-year growth of around 10%. This is also a 79% increase as compared with the first year after the launch of the TVC (i.e. 31 March 2020). About one-third of the TVC accounts are held by MPF scheme members below age 45, showing that many young scheme members attach importance to early planning for retirement protection.

The working population is encouraged to take advantage of the flexibility offered by TVC to enhance their retirement reserves. After setting up a TVC account, scheme members may determine the frequency and amount of TVC contributions to suit their personal financial circumstances and capability. They may also adjust or suspend contributions, or transfer the entire balance of a TVC account of an MPF scheme to a TVC account of another MPF scheme at any time. As the economy gradually improves, Mrs Lau encouraged scheme members to maintain the discipline of making regular TVC or even increase the amount of TVC for long-term planning.

Furthermore, Mrs Lau emphasized that the MPF is a long-term investment and TVC will add value to the retirement reserves through compounding effect. Together with the MPF derived from mandatory contributions, TVC will further enhance retirement protection. If a 45-year-old MPF scheme member makes $5,000 of TVC every month (i.e. $60,000 of TVC per year) in addition to a monthly mandatory contribution of $3,000 (including the contribution made by the employer), with the assumption that the average annualized rate of net return is 3.7%1, it is estimated that nearly $1.8 million of MPF could be generated from TVC after 20 years, and the total MPF accumulated is estimated to amount to more than $2.8 million2 if the accumulated MPF from mandatory contributions in the same period is included.

The blog also mentioned that the Financial Secretary has proposed another tax measure in the 2023-24 Budget to encourage voluntary MPF contributions. The proposed measure will increase the tax deduction for MPF voluntary contributions made by employers for their employees aged 65 or above from the current 100% to 200% of such expenditure. Mrs Lau considered this a triple-win solution and that the MPFA would render full support to the Government in formulating the implementation details.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

28 May 2023

1. Assuming the MPF scheme member invests in a mixed assets fund. Since the inception of the MPF System to 31 March 2023, the average annualized net return (fees and charges deducted) of mixed assets fund was 3.7%.

2. The related estimation of the MPF is a future value, which does not reflect the impact of inflation. The example is for illustration only and does not imply the actual value of the MPF generated by making TVC.