- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA Blog - MPFA continues to drive fee reduction

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA Blog - MPFA continues to drive fee reduction

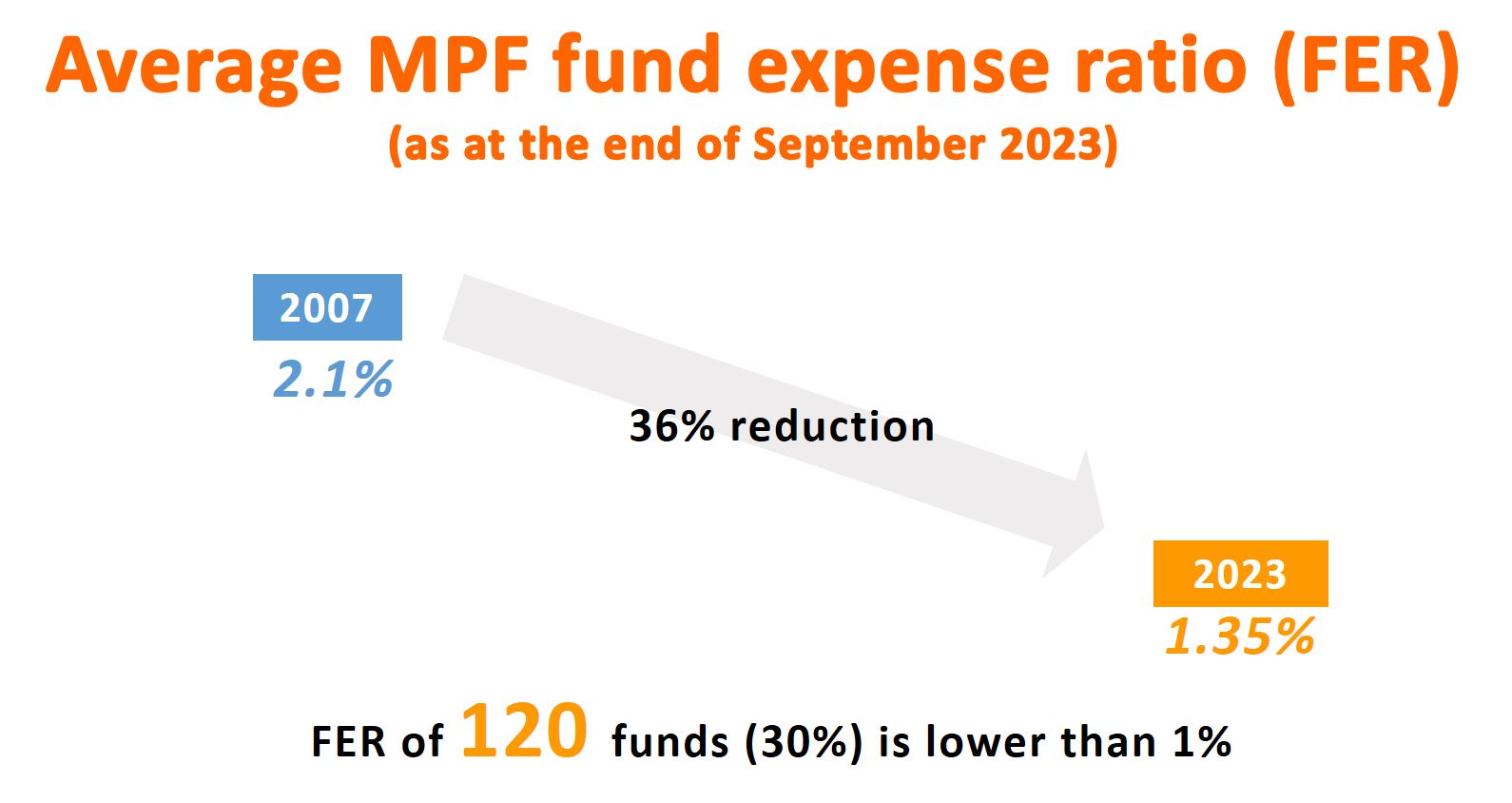

MPFA Chairman Mrs Ayesha Macpherson Lau published her latest blog post today (29 October), stressing that the MPFA adheres to the principle of protecting scheme members’ interest and has been consistently driving fee reduction. The average fund expense ratio (FER)1, which measures the MPF fee levels, dropped from 2.1% in 2007 to 1.35% as at the end of September this year, a decrease of 36%. Among 404 MPF funds, the FER of 120 funds (30%) was lower than 1%. While there is a notable decrease in fees over the years, the MPFA considers there is still room for further fee reduction.

She pointed out that, to enhance the transparency of fees, the MPFA launched the MPF Fund Platform in 2019 with breakdown of fees, prompting MPF trustees to disclose the details of three major components under the management fees of MPF funds, namely administration fee, investment management fee and sponsor fee. Apart from helping scheme members better understand the rationale behind the fees charged by the trustees so as to make informed fund choices, this will also facilitate the MPFA to drive fee reduction in a more targeted and sustained manner.

Given that administration fee is the largest component accounting for over 40% of fund fees, Mrs Lau said that the aim of the eMPF Platform, which is now being developed at full steam by the MPFA, is to lower administration fee. Within the first two years after the implementation of the eMPF Platform, it is expected that an average reduction of 30% in the administration fee payable by scheme members. The project is estimated to achieve cumulative administration cost savings of $30 billion to $40 billion over a 10-year period, equivalent to 41% to 55% of the original administration fee during the period. As stipulated in the legislation, upon phased onboarding of MPF trustees to the eMPF Platform from the second quarter of 2024, the administration cost savings will be passed straight on, leading to a corresponding reduction in administration and overall fund fees, thus benefiting scheme members.

For fund expenses other than the administration fee, which include investment management fee and sponsor fee, the MPFA has already asked trustees to review whether there is room for fee reduction in their funds and submit a five-year fee reduction strategic plan to the MPFA.

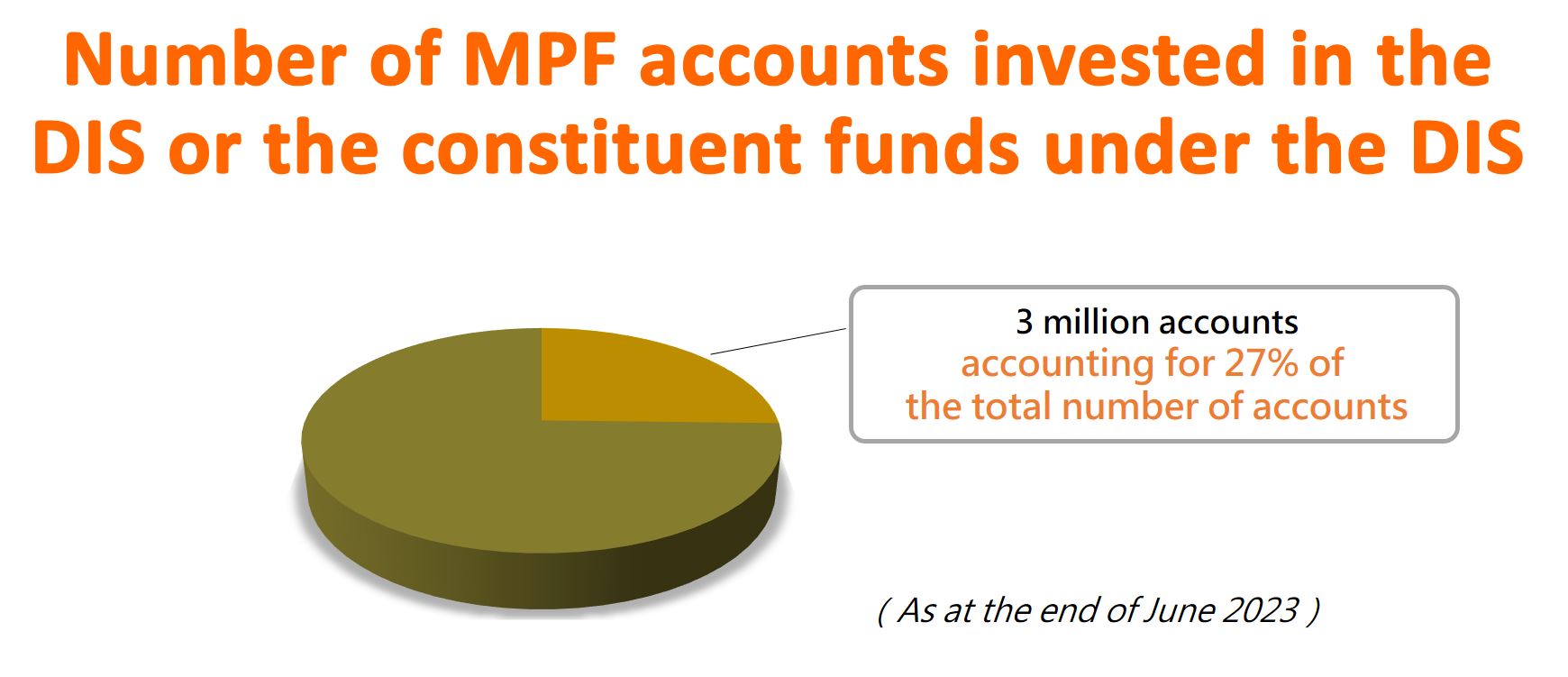

Mrs Lau also reminded scheme members that the fee level should not be the sole factor for consideration when selecting MPF funds, as fund performance is also an important factor to determine whether a fund offers value for money. If scheme members lack time or investment knowledge, they may consider choosing the "default investment strategy (DIS)" (also known as “funds for lazy people”). The constituent funds under the DIS are subject to fee caps, which require management fees and recurrent out-of-pocket expenses not to exceed 0.75% and 0.2% of the net asset value of a fund respectively; and the latter will be further reduced to 0.1% after individual trustees and schemes have onboarded the eMPF Platform. As of June this year, 3 million MPF accounts, accounting for 27% of the total number of accounts, invested in the DIS or the constituent funds under the DIS. Both the total number of accounts and the percentage have been steadily increasing. Since the launch of the DIS on 1 April 2017 until September this year, the core accumulation funds under the DIS have achieved an average annualized net return of 4.4%, outperforming other MPF fund types.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

1. The fund expense ratio reflects the fees and expenses of an MPF fund as a percentage of the net asset value of the fund.