- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA releases the September 2023 Issue of the Mandatory Provident Fund Schemes Statistical Digest quarterly report

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA releases the September 2023 Issue of the Mandatory Provident Fund Schemes Statistical Digest quarterly report

The MPFA today (29 November) released the September 2023 issue of the Mandatory Provident Fund Schemes Statistical Digest (Statistical Digest), a quarterly report which covers key statistical data of the MPF System up to the end of September 2023, including scheme member enrolment, number of accounts, total MPF assets and investment performance, etc.

The Statistical Digest aims to enhance information transparency of the MPF by showing the general situation and progress of the MPF System in different areas.

Key findings in the September 2023 issue of the Statistical Digest are as follows:

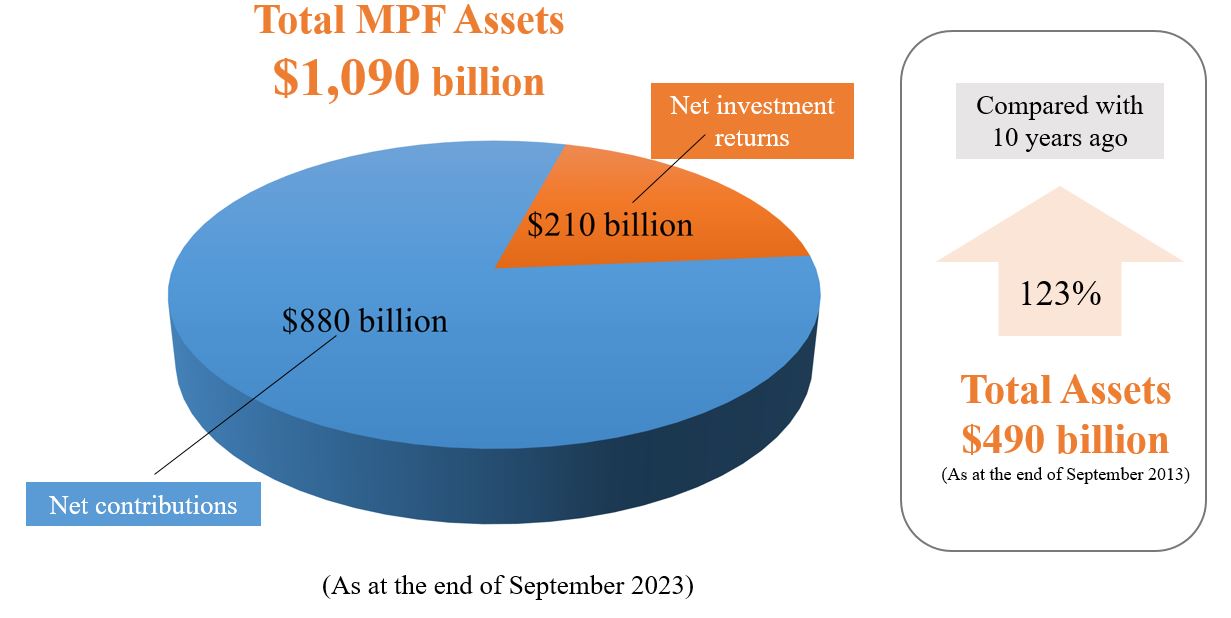

- As at the end of September 2023, total MPF assets amounted to $1,090 billion, increasing by 123% over the past 10 years. $210 billion of the total MPF assets was investment returns, net of fees and charges.

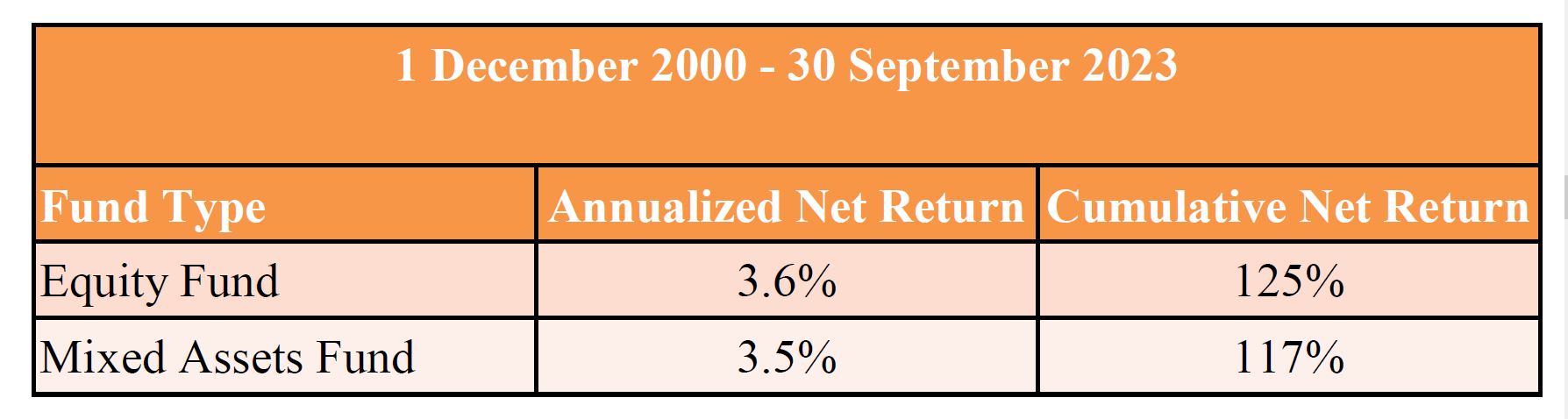

- Since the inception of the MPF System in 2000, MPF equity funds and mixed assets funds, which accounted for nearly 80% of the total net asset value of MPF, registered on average an annualized net return of 3.6% and 3.5% respectively, exceeding the annualized inflation of 1.8% for the same period. The cumulative net returns of MPF equity funds and mixed assets funds were 125% and 117% respectively.

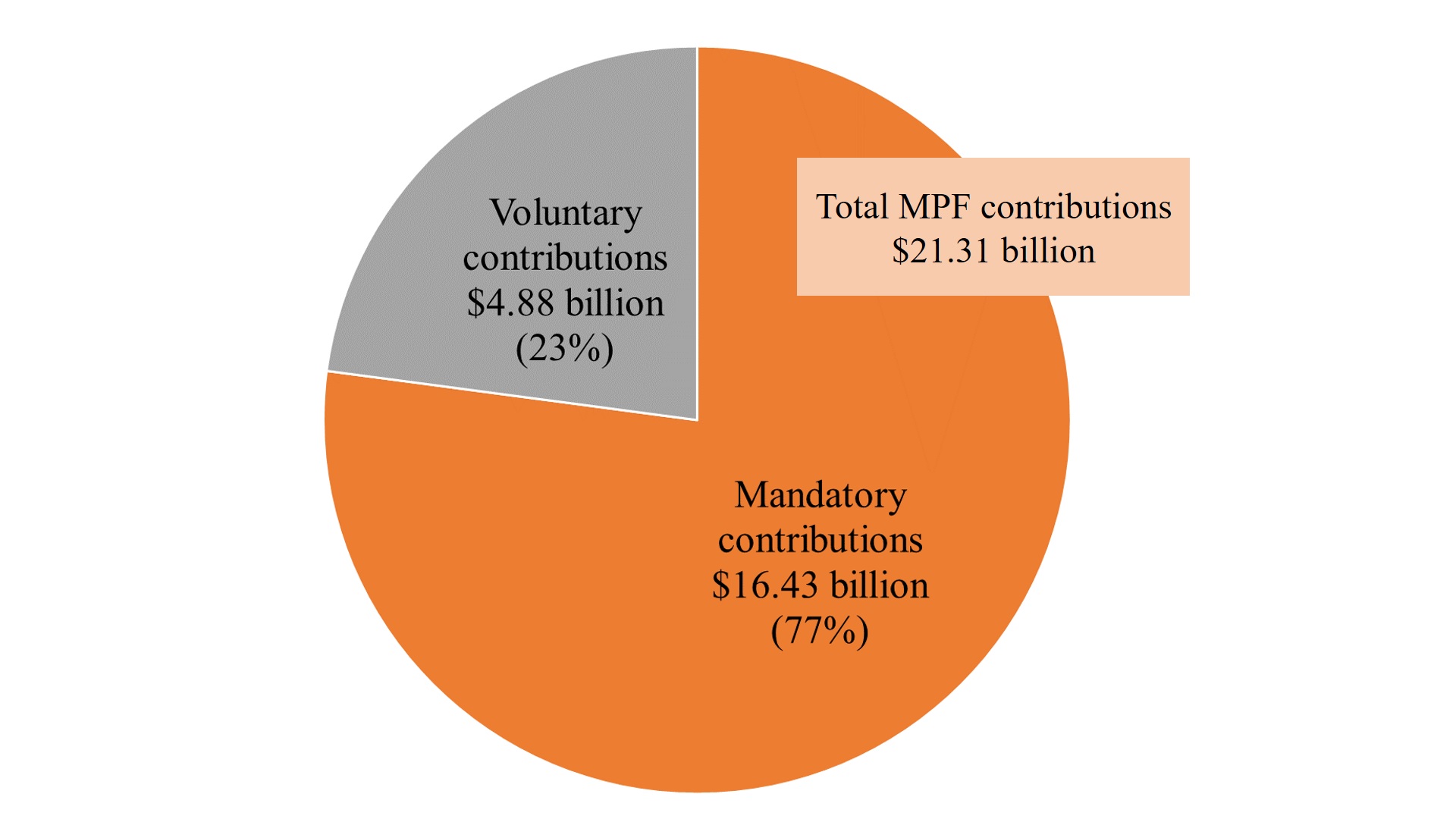

- Total MPF contributions amounted to $21.31 billion in the third quarter of 2023, of which $16.43 billion (77%) was mandatory contributions and $4.88 billion (23%) was voluntary contributions.

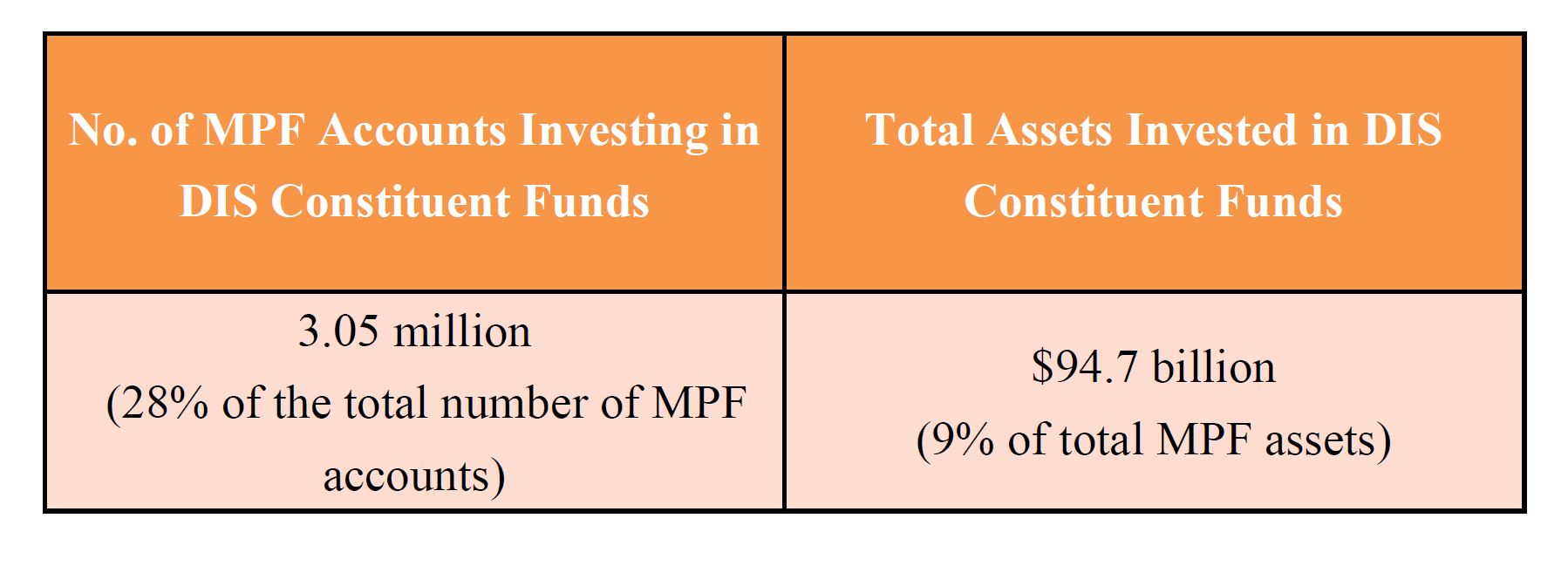

- As at the end of September 2023, there were 3.05 million MPF accounts investing all or part of their assets according to the default investment strategy (DIS) or in the two constituent funds under the DIS, accounting for 28% of the total number of 11.01 million MPF accounts at the time. The total assets invested amounted to $94.7 billion, accounting for 9% of total MPF assets.

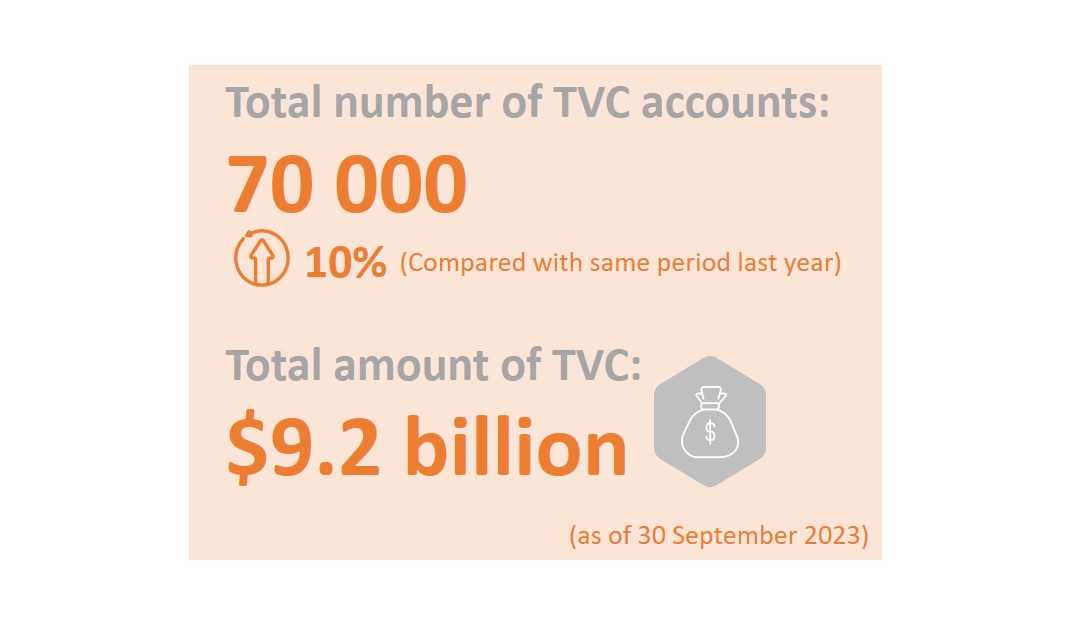

- As at 30 September 2023, the total amount of tax-deductible voluntary contributions (TVC) received was $9.2 billion. The number of TVC accounts was 70 000, reflecting a year-on-year growth of 10%.

- The number of claims for MPF on the grounds of permanent departure (PD) from Hong Kong in the third quarter of 2023 was 8 700, on a par with the same quarter last year and 7% lower than that in the same quarter of 2021. The number of PD claims fluctuated from time to time. Since a scheme member may have more than one account under the MPF System and would make individual claims with the relevant trustees to withdraw his/her MPF from these accounts, the number of claimants involved would be less than the number of claims. In addition, PD claimants may not be emigrants as such claimants also include those returning to their places of origin (e.g. non-local employees who have completed their employment in Hong Kong) or moving to reside in the Mainland.

-Ends-

29 November 2023