- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - DIS delivers value for money

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - DIS delivers value for money

MPFA Chairman Mrs Ayesha Macpherson Lau published her latest blog post today (28 January), pointing out that despite the heightened volatilities experienced in global investment markets last year, MPF recorded an overall net return of 3.5% in 2023. All six MPF fund types (equity funds, mixed assets funds, bond funds, guaranteed funds, MPF conservative funds and money market funds) posted positive returns.

Mrs Lau noticed two common views voiced out by the public when selecting funds – (1) “low fee trumps everything” and (2) “eyeing on returns only”; she cautioned that both have their own blind spots. The former view considered the lower the fee, the better the fund. However, the fee level should not be the sole factor to consider in making investment decisions. Instead, it is more appropriate to examine whether a fund offers value for money. If a fund adopts a more active management strategy which results in better returns persistently, it represents greater value for money than a fund that charges lower fees but delivers lower returns persistently. The latter view considered the past investment performance of a fund to be the only criterion when selecting funds, ignoring the differences of investment objectives and risk levels among different fund types. In general, funds with the potential to generate higher investment returns are associated with greater investment risk.

Mrs Lau encouraged scheme members not to rely on a single factor to evaluate whether a fund offers value for money or not. They should take into consideration their personal circumstances, such as their stage of life and risk-tolerance level, and select a suitable fund type commensurate with their personal circumstances. They can then evaluate and compare the funds in that fund type. She recommended that scheme members make good use of the "MPF Fund Platform" on the MPFA website to choose MPF funds with good value for money by checking the details of fees and performance of different funds.

To help scheme members further understand whether their selected funds offer value for money, the MPFA requires MPF trustees to conduct a value-for-money assessment of their MPF schemes and disclose the assessment results and follow-up action in their annual governance reports. MPF trustees have already submitted their first annual governance report for each MPF scheme to the MPFA and published them on their own websites. The reports were also uploaded to the MPFA website for public viewing.

Mrs Lau also highlighted that the default investment strategy (DIS, also commonly known as “funds for lazy people”), was designed to deliver value for money. DIS is made up of two mixed assets funds: the Core Accumulation Fund (CAF) and the Age 65 Plus Fund. It follows the principle of diversification of investment, investing in global equity and bond markets, which helps diversify investment risks across regions and asset classes. Its “automatic de-risking” feature ensures adjustment of the equity-bond ratio to match the different stages of life of scheme members, providing scheme members with more convenient, comprehensive and thoughtful services. The fee of DIS funds is capped at 0.95% of the net asset value of the fund, and the cap will be further reduced to 0.85% after account data of an MPF scheme have been migrated to the eMPF Platform.

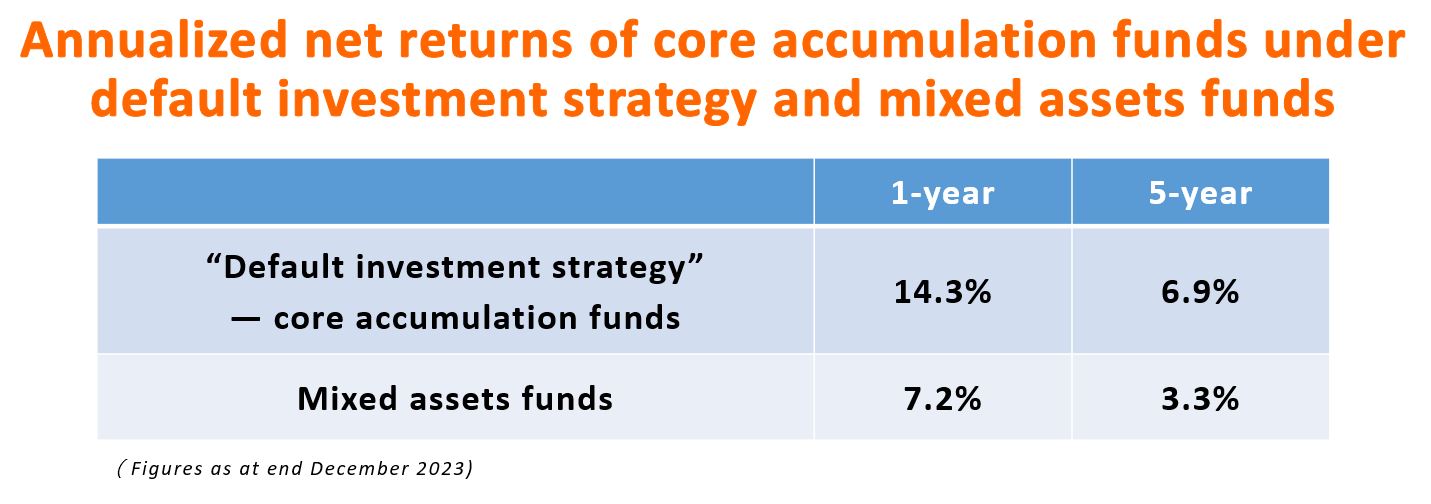

As at 31 December 2023, the average fund expense ratio (FER) of DIS funds was 0.78%, which was over 40% lower than the average FER of 1.35% in respect of mixed assets funds as a whole. In terms of investment performance, despite experiencing considerable market volatilities since the launch of the DIS in April 2017, the CAF under the DIS recorded a positive average cumulative net return of 43.4%, with both one-year and five-year annualized net returns outperforming the overall average annualized net returns of mixed assets funds.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

28 January 2024