- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - Modern women should be more proactive in planning for retirement protection

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - Modern women should be more proactive in planning for retirement protection

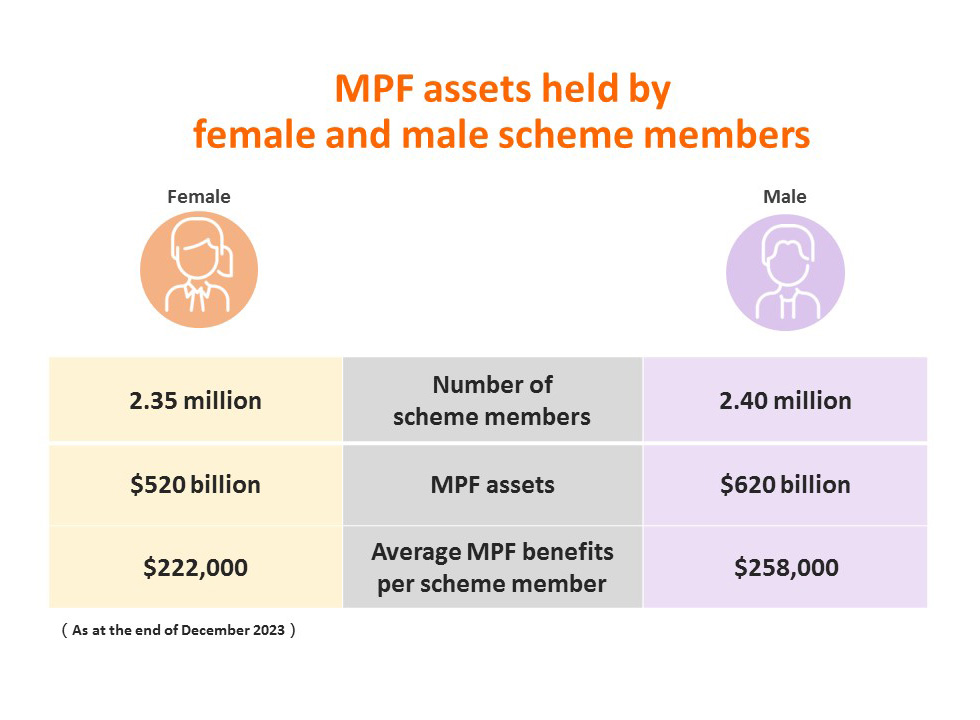

MPFA Chairman Mrs Ayesha Macpherson Lau published her latest blog post today (25 February), pointing out that according to MPFA figures, as at the end of 2023, there were about 2.35 million female and 2.4 million male scheme members. Female scheme members held approximately $520 billion in MPF assets, while male scheme members held approximately $620 billion in total, representing average MPF assets of $222,000 held by each female and $258,000 by each male scheme member. In terms of asset allocation, 76% of female scheme members' MPF assets were invested in equity funds and mixed assets funds, similar to the proportion of 78% for male scheme members.

To better cope with retirement needs, Mrs Lau suggested female scheme members consider making voluntary contributions to enhance their retirement reserves. Tax-deductible voluntary contributions (TVC) was introduced in 2019 to encourage scheme members to make additional contributions by providing tax incentives. She said, assuming a scheme member starts making monthly TVC of $1,500 at the age of 22 with an average annualized rate of net return of 5.5%1 , it is estimated that the scheme member would accumulate nearly $3.14 million2 in additional MPF assets from TVC when the scheme member reaches the retirement age of 65. In fact, 43% of the 72,000 TVC account holders are female.

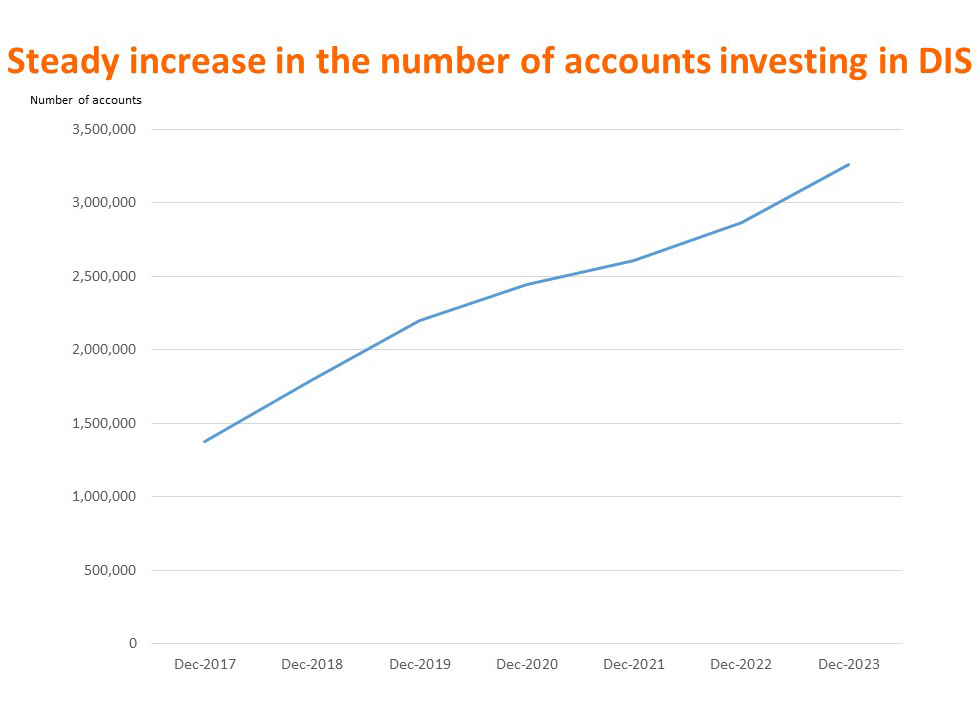

Mrs Lau also pointed out that working women play multiple roles and are very busy in life, she therefore suggested them consider using default investment strategy (DIS), also known as “funds for lazy people”, for retirement protection planning. DIS provides value for money, given its three advantages in design: fee caps, automatic de-risking and a diversified investment approach. In the past year, the net return of the Age 65 Plus Fund and the Core Accumulation Fund under DIS were 7.3% and 14.3%, respectively. As at December 2023, approximately 3.3 million MPF accounts invested in DIS, with a steady year-on-year increase of about 14%. Three out of every 10 MPF accounts invested in DIS, indicating its increasing popularity among scheme members. Of all MPF assets investing in DIS, 44.5% were held by female scheme members.

Mrs Lau said that the MPFA aims to commence the migration of MPF account information to the eMPF Platform in the second quarter of this year, with the whole onboarding process expected to be completed in 2025. Once the Platform is fully operational, scheme members will be able to manage all MPF matters in one place via mobile app or website, including opening and consolidating accounts, and switching schemes or funds, thus making MPF management faster, easier and more convenient. Currently, the top priority of the MPFA is to ensure that the Platform will be launched according to schedule and design requirements, so that it will be “convenient, easy and enjoyable to use”, saving time and costs for scheme members in managing their MPF and achieving the objective of driving fee reduction. Mrs Lau reminded the working population to stay tuned.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

MPFA Chairman Mrs Ayesha Macpherson Lau met with a group of Sham Shui Po residents earlier to introduce the latest MPF information to them and listen to their views about the MPF and retirement protection. During the visit, Mrs Lau distributed MPF Chinese New Year gift bags to the attendees to celebrate the Chinese New Year.

-Ends-

25 February 2024

1. Assuming that the scheme member invests in the Core Accumulation Fund (CAF) under default investment strategy (DIS). From the launch of DIS in April 2017 to December 2023, the average annualized net return (net of fees and charges) of the CAF was 5.5%.

2. The related estimation of the MPF is a future value, which does not reflect the impact of inflation. The example is for illustration only and does not imply the actual value of the MPF generated by making TVC.