- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA releases provisional data on MPF investment returns

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA releases provisional MPF investment returns

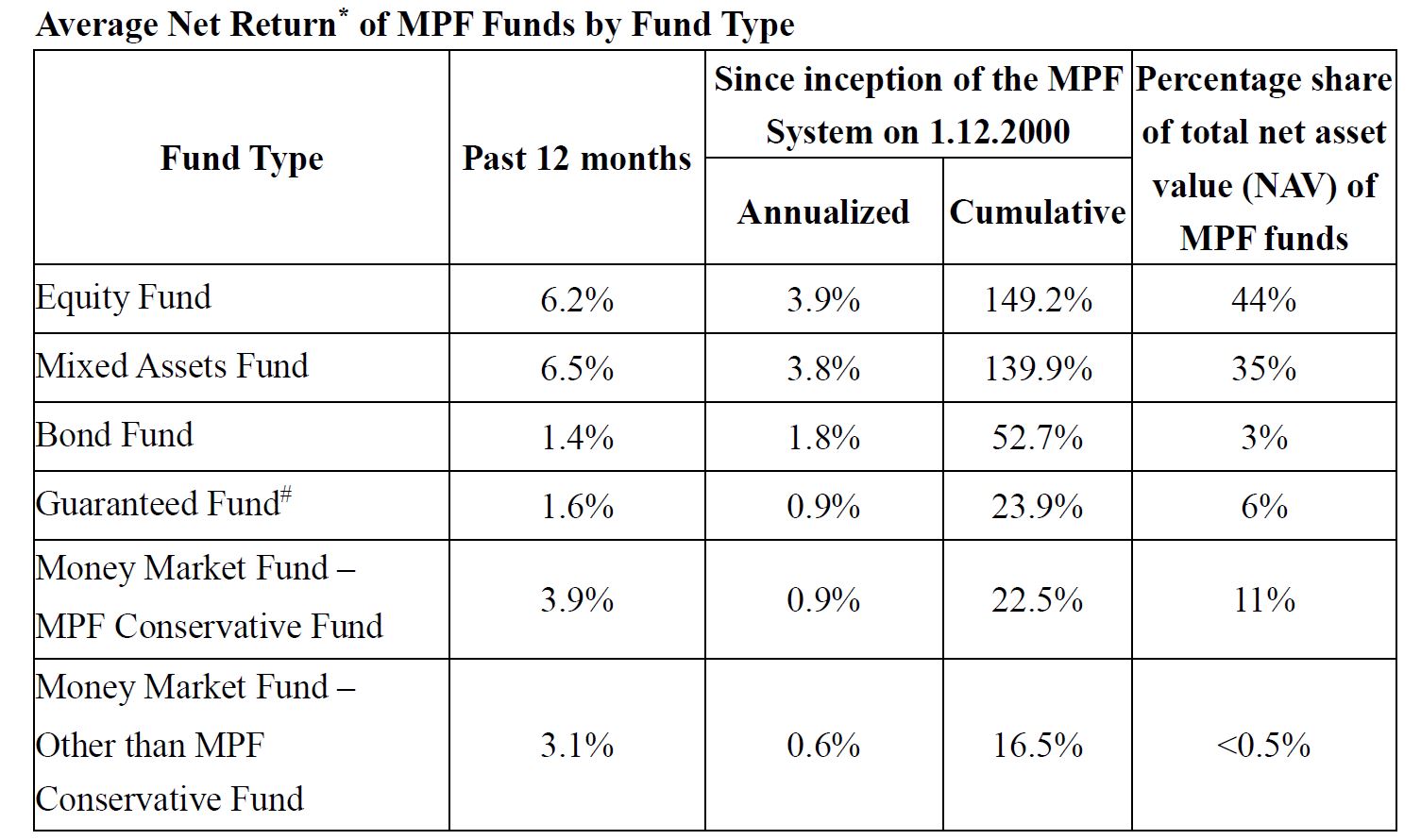

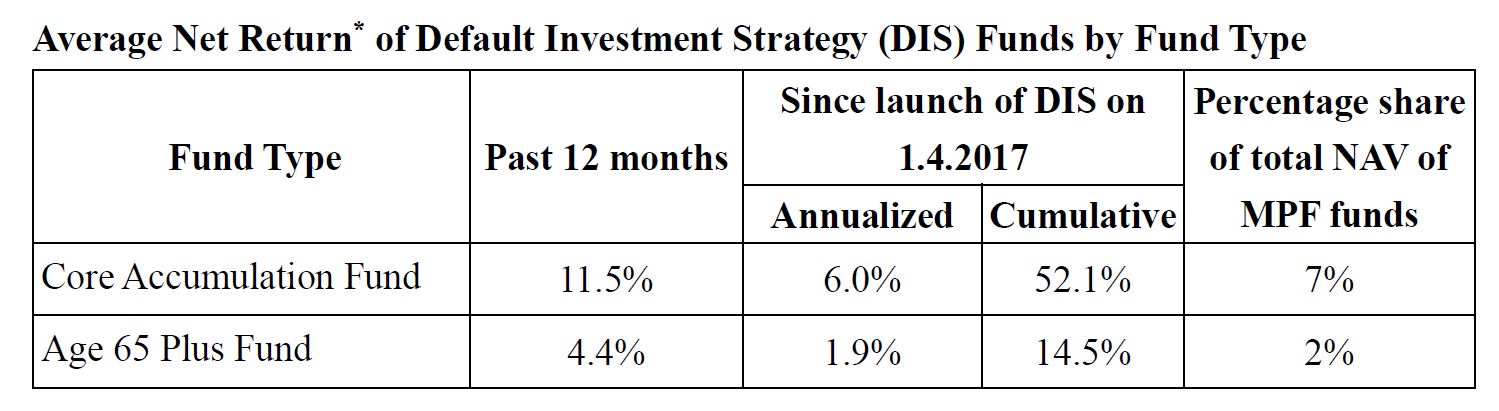

The MPFA today (8 July) released provisional data on MPF investment returns as at end June 2024. The provisional figures by fund types are shown below:

The MPFA spokesperson reiterated that MPF is a long-term investment spanning over 40 years. Scheme members should not adopt a short-term investment approach in managing MPF and try to time the market. MPF is designed to help scheme members build up their nest egg and benefit from dollar-cost averaging through making fixed amounts of MPF contribution on a regular basis and invest in accordance with personal needs in different life stages.

In addition, under the MPF System, funds investing in different markets and asset classes are provided to facilitate the building of a diversified investment portfolio by scheme members to mitigate investment risk. Scheme members are advised to review their MPF portfolio regularly taking into consideration factors such as their life stage, financial situation, risk tolerance level, etc. Scheme members are encouraged to make good use of the “MPF Fund Platform” on the MPFA website to learn more about details of individual MPF funds and select funds or portfolios that best suit their needs. Scheme members who have no time for or are unfamiliar with managing their MPF investment may consider choosing the default investment strategy (DIS), commonly called “funds for lazy people”. DIS uses a diversified investment approach by investing in global equity and bond markets which, coupled with its “automatic de-risking” feature, can effectively reduce risk. In addition, DIS funds are subject to fee caps at 0.95% of NAV of the fund, indirectly increasing net returns.

– Ends –

8 July 2024

* Return figures are net of fees and charges.

# Return figures do not represent the guaranteed rates of returns. The actual investment return for a scheme member depends on whether the scheme member fulfills the qualifying conditions of a guaranteed fund.