- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - Utilize relevant information as a smart MPF scheme member

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - Utilize relevant information as a smart MPF scheme member

MPFA Chairman Mrs Ayesha Macpherson Lau published her blog post today (29 September), reminding scheme members to carefully identify and understand different MPF-related information available in the market when managing their MPF. She pointed out that general information focusing on the overall market performance may not be the most relevant reference for scheme members in planning their retirement protection. She suggested scheme members making reference to more personalized data which offer more insights on their individual situations, and developing appropriate investment strategies for retirement protection in accordance with risk tolerance level in different life stages.

Mrs Lau elaborated that the overall investment return of the MPF System is an average figure reflecting collective investment decisions made by over four million MPF scheme members. This average figure is merely a generalized statistical value, which has no direct correlation with the investment returns of individual scheme members because the portfolio of each scheme member has different risk level and the markets invested have different performance, leading to diversity in returns.

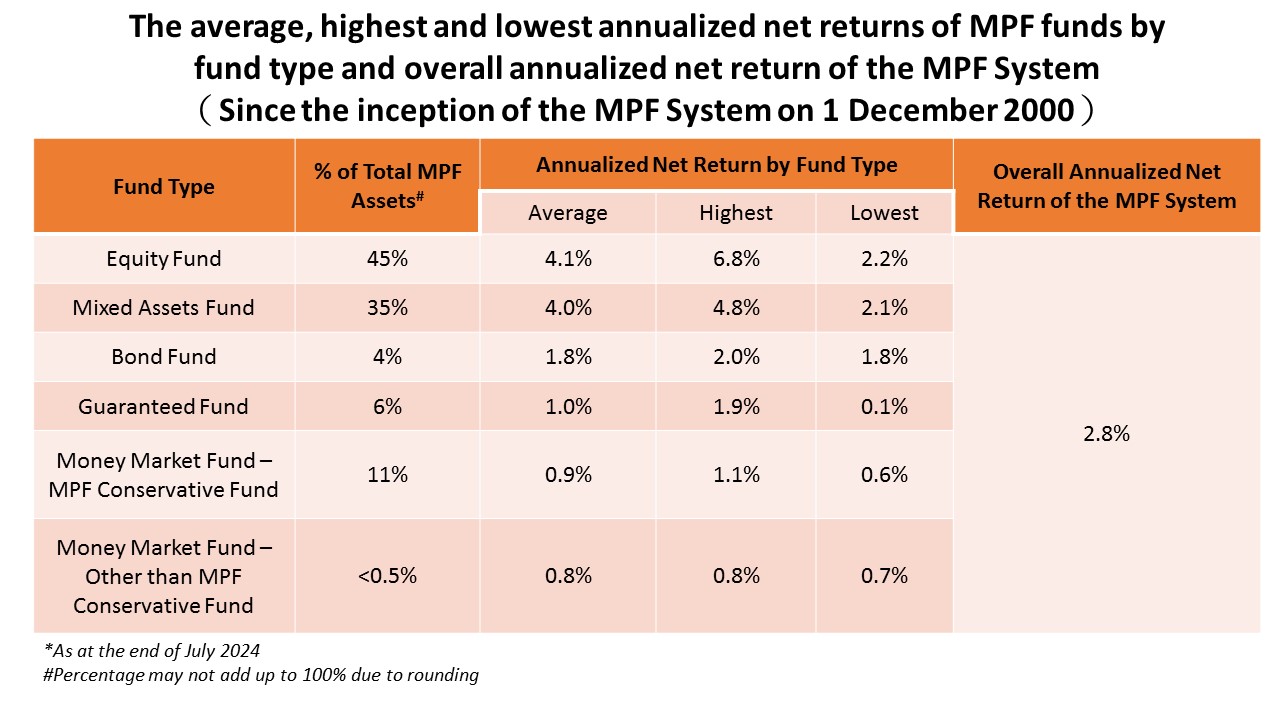

Mrs Lau cited the following MPF data to show that there exists considerable difference between the overall annualized net return of the MPF System and the annualized net returns of individual fund types.

As at the end of July this year, the overall annualized net return of the MPF System since its inception was 2.8%, but the annualized net returns of the six fund types are different. For example, Equity Fund and Mixed Assets Fund, which together accounted for 80% of total MPF assets, registered an average annualized net return of 4.1% and 4% respectively. The aggregate average figure of the net return derived from a total of nearly 400 funds, therefore, can serve only as a general reference, falling short of providing a comprehensive reference for individual MPF investment decisions.

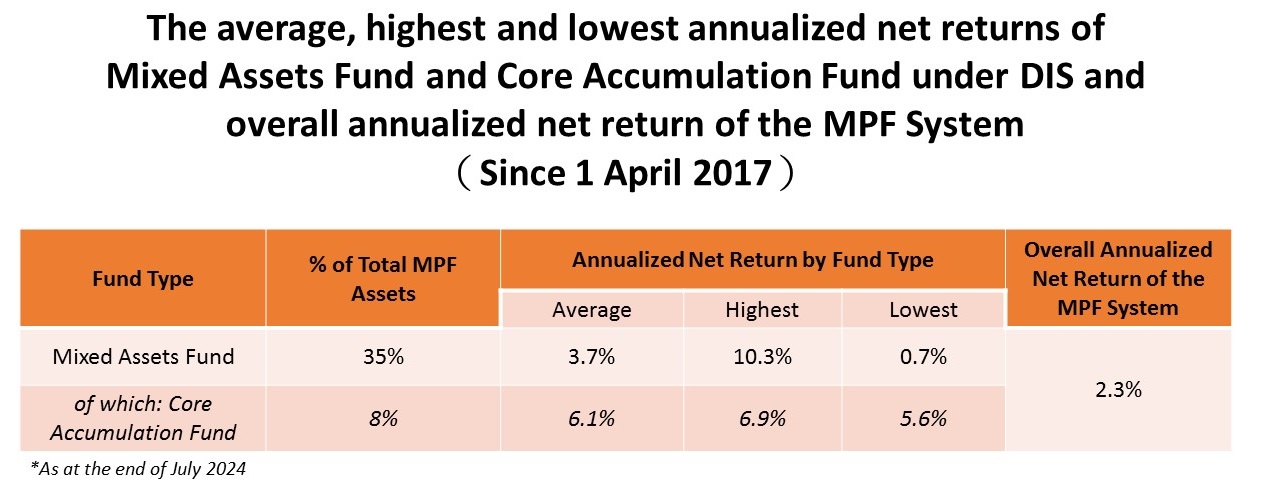

From another perspective, the performance of different funds under the same fund type can also vary. For instance, the Core Accumulation Fund under the default investment strategy (DIS) is a type of Mixed Assets Fund. Since April 2017 (i.e. when DIS was launched), the Core Accumulation Fund registered an average annualized net return of 6.1%, which is significantly different from the overall performance of Mixed Assets Fund during the same period (see following table).

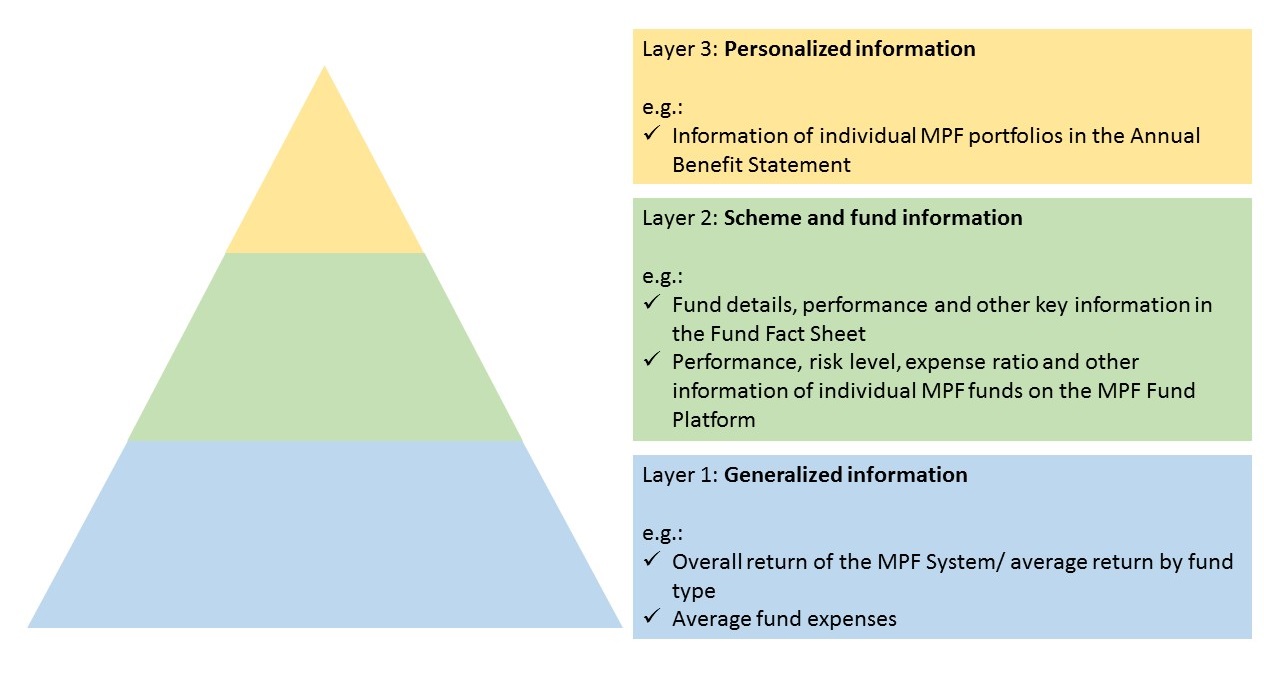

Mrs Lau also introduced in the Blog article an “information pyramid” which categorizes information related to MPF investment into three layers:

The bottom layer of the “information pyramid” reflects the overall return of the MPF System and average returns of different fund types, which are the information more frequently cited and talked about by the media and commentators. Layer 2 information comprises details on funds and their respective performance, etc., which can be found in Fund Fact Sheets, information provided by individual MPF schemes and funds, and the MPFA’s MPF Fund Platform. This layer of information can help scheme members better understand the investment objectives, risk levels, fund expense ratios, performance under different timespan, etc., of individual funds, which are very useful references for members in selecting funds and building up a personalized investment portfolio. She strongly encouraged employees to take reference from layer 2 information, which better fits the needs of scheme members when selecting MPF funds.

The most direct and valuable reference for scheme members when reviewing their MPF portfolios is the personalized data which sit at the apex of the “information pyramid”. Information at this layer can be found in the Annual Benefit Statement (ABS) issued by trustees every year. It records the latest status of the scheme member’s investment portfolio and a summary of the contributions and investments over the previous year, including inflows and outflows to and from the account, the account balance and investment return, etc.

She also highlighted that following the launch of the eMPF Platform (the eMPF) and the gradual onboarding of each MPF scheme, comprehensive, real-time information for all MPF accounts of scheme members will be readily accessible at one glance. By then, all scheme members will be able to easily browse and download the ABS of their MPF accounts across different schemes from the eMPF, and the information related to returns and fees provided by the ABSs will be further enhanced. MPF members can make use of this one-stop centralized digital platform to access their personal MPF information and manage their MPF anytime anywhere. Those who lack the time or investment knowledge to manage their MPF can consider the DIS, which adopts a diversified investment approach by investing in global equity and bond markets as well as an “automatic de-risking” mechanism which gradually reduces exposure to high risk assets according to age, thereby effectively reducing investment risk. The fee of DIS funds is also capped at 0.95% of the net asset value of the funds and the cap will be further reduced to 0.85% after an MPF scheme has onboarded the eMPF.

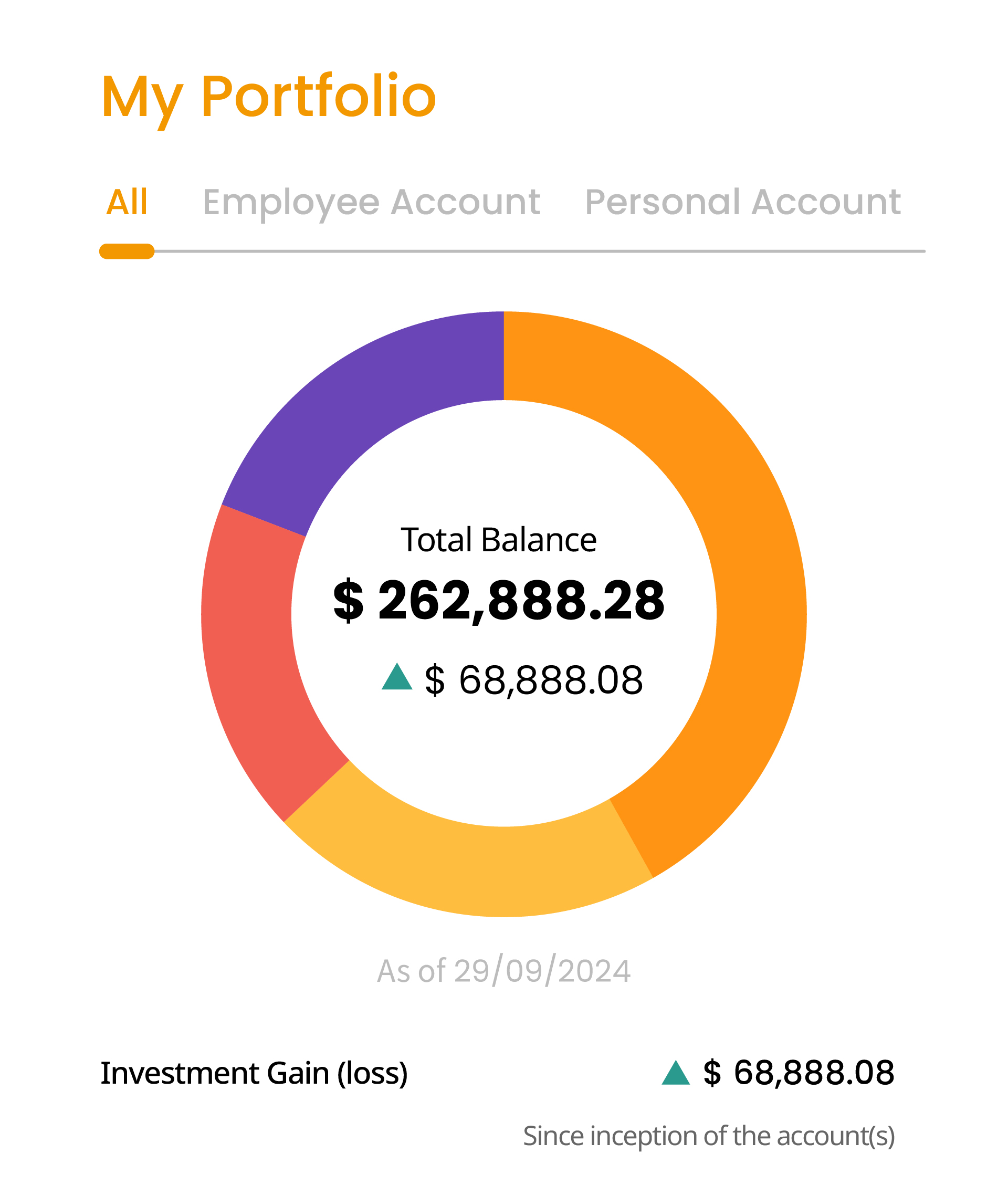

When your enrolled MPF scheme gets onboard the eMPF, your eMPF account will display a donut chart, showing information on your MPF investment performance from different trustees and schemes at a glance.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

29 September 2024