- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- The MPFA releases provisional data on MPF investment returns

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

The MPFA releases provisional data on MPF investment returns

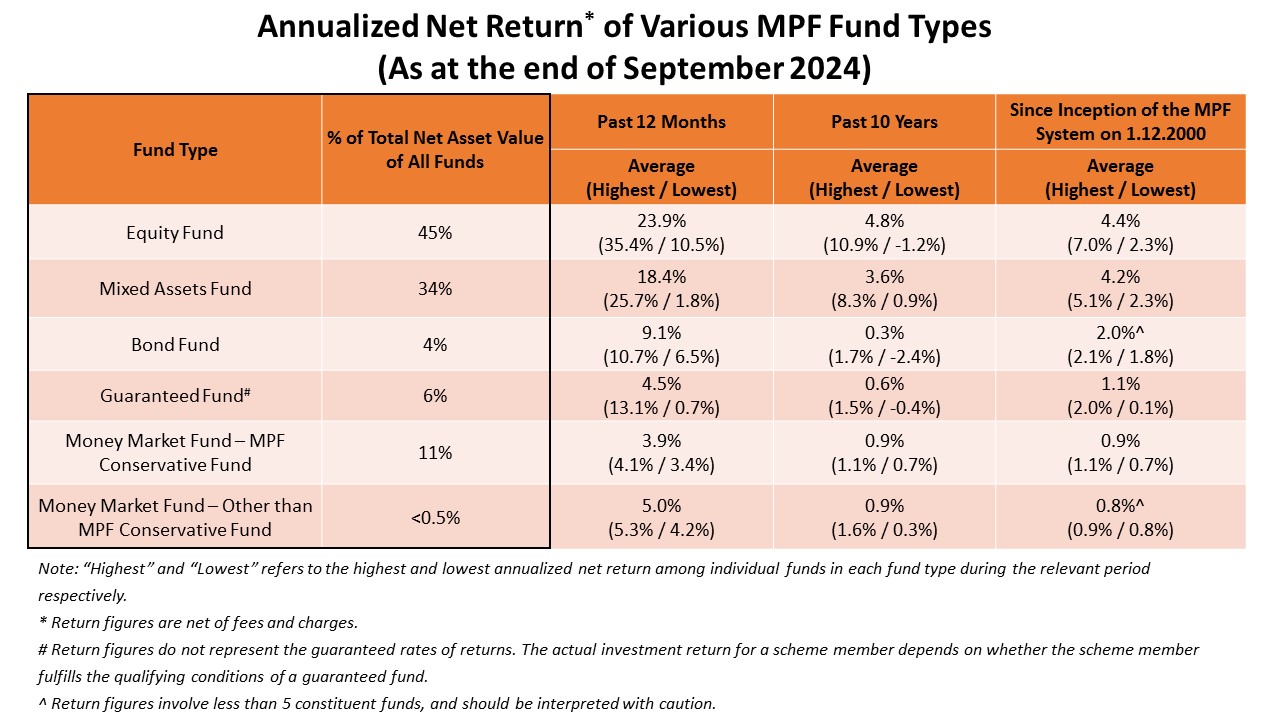

The MPFA today (9 October) released its provisional data on MPF investment returns as at the end of September 2024. The provisional figures by fund type are as follows:

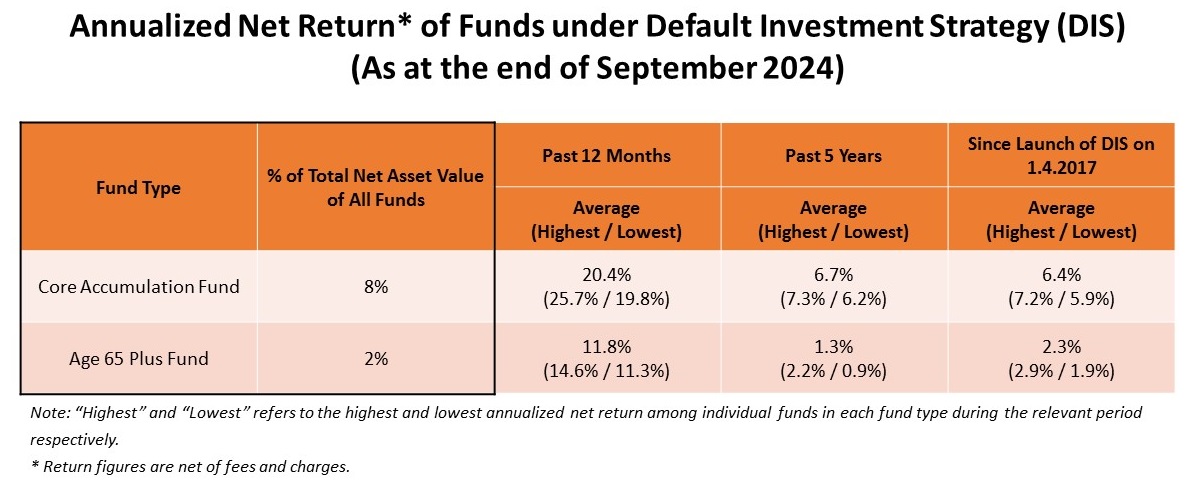

An MPFA spokesperson said that Equity Fund and Mixed Asset Fund, which together accounted for close to 80% of total MPF assets, recorded average net returns of 23.9% and 18.4%, respectively, over the previous 12 months, and registered average annualized net returns of 4.4% and 4.2% since the inception of the MPF System. Regarding Core Accumulation Fund under default investment strategy (DIS), its average net return over the previous 12 months and average annualized net return since launch were 20.4% and 6.4%, respectively.

The MPFA reminded scheme members that the MPF is a long-term investment, spanning over 40 years. Scheme members should make sound investment plans based on their life stage, financial situation and risk-tolerance level. Scheme members should not adopt a short-term investment approach in managing their MPF and try to time the market. Also, the average investment returns of individual fund types are generalized statistical values, which can serve only as a general reference. Scheme members are advised to refer to the annual benefit statement (ABS) issued by their MPF trustee(s) every year during their regular review of their MPF portfolio. Scheme members should examine their investment objectives and risk-tolerance level, and the fund expense ratios and performance over different time horizons, as well as other information about individual funds, to build up a personalized MPF investment portfolio. This kind of information can be found in the fund fact sheets, information provided by individual MPF schemes and funds, and the MPFA’s MPF Fund Platform. Scheme members may refer to September issue of the MPFA Chairman’s blog post (Chinese only) to learn how to effectively manage their MPF by utilizing personalized information.

The spokesperson added that employees who lack the time or investment knowledge to manage their MPF can consider DIS, which adopts a diversified investment approach by investing in global equity and bond markets and includes an “automatic de-risking” mechanism, which gradually reduces exposure to high-risk assets according to age, thereby effectively reducing investment risk. The fee of funds under DIS is capped at 0.95% of the net asset value of the funds. The cap will be further reduced to 0.85% after the respective MPF scheme joins the eMPF.

– Ends –

9 October 2024