- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA releases the December 2024 Issue of the Mandatory Provident Fund Schemes Statistical Digest quarterly report

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA releases the December 2024 Issue of the Mandatory Provident Fund Schemes Statistical Digest quarterly report

The MPFA today (28 February) released the December 2024 issue of the Mandatory Provident Fund Schemes Statistical Digest (Statistical Digest), a quarterly report which covers key statistical data of the MPF System up to the end of December 2024, including scheme member enrolment, number of accounts, total MPF assets and investment performance.

The Statistical Digest aims to enhance information transparency of the MPF by showing the general situation and progress of the MPF System in different areas.

Key findings in the December 2024 issue of the Statistical Digest are as follows:

- As at the end of December 2024, total MPF assets amounted to around $1,290 billion, increasing by 128% over the past 10 years.

- Since the inception of the MPF System in 2000, MPF equity funds and mixed assets funds, which together accounted for nearly 80% of total MPF assets, registered on average annualized net returns of 4.3% and 4.0% respectively, exceeding the annualized inflation rate of 1.8% for the same period.

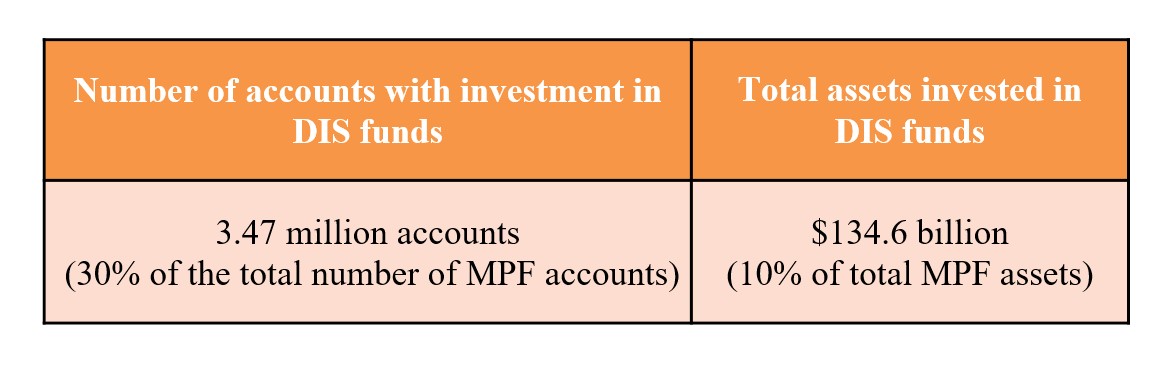

- As at the end of December 2024, there were 3.47 million MPF accounts with investment in the DIS funds, accounting for 30% of the total number of 11.23 million MPF accounts at the time. The total assets invested amounted to $134.6 billion, accounting for 10% of total MPF assets#.

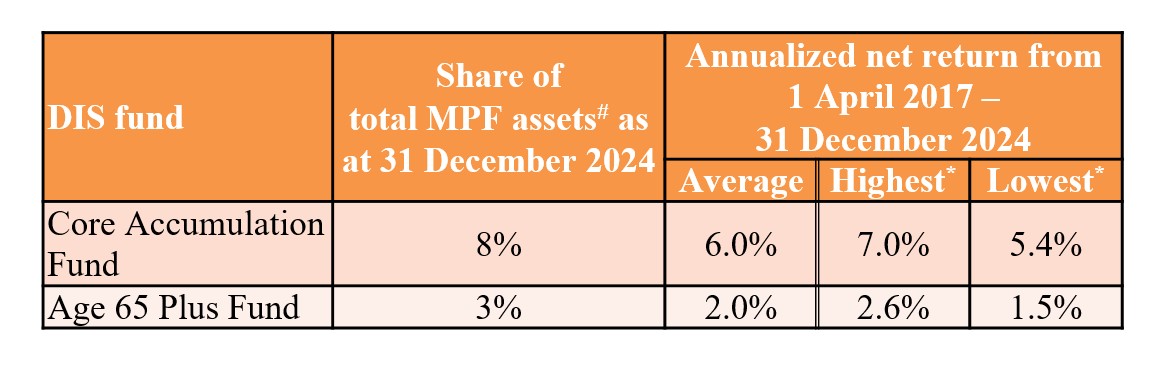

- As at the end of December 2024, the average annualized net returns since the launch of the DIS on 1 April 2017 of the Core Accumulation Fund (CAF) and Age 65 Plus Fund (A65F) were 6.0% and 2.0% respectively, higher than the 1.8% annualized inflation rate recorded in the same period.

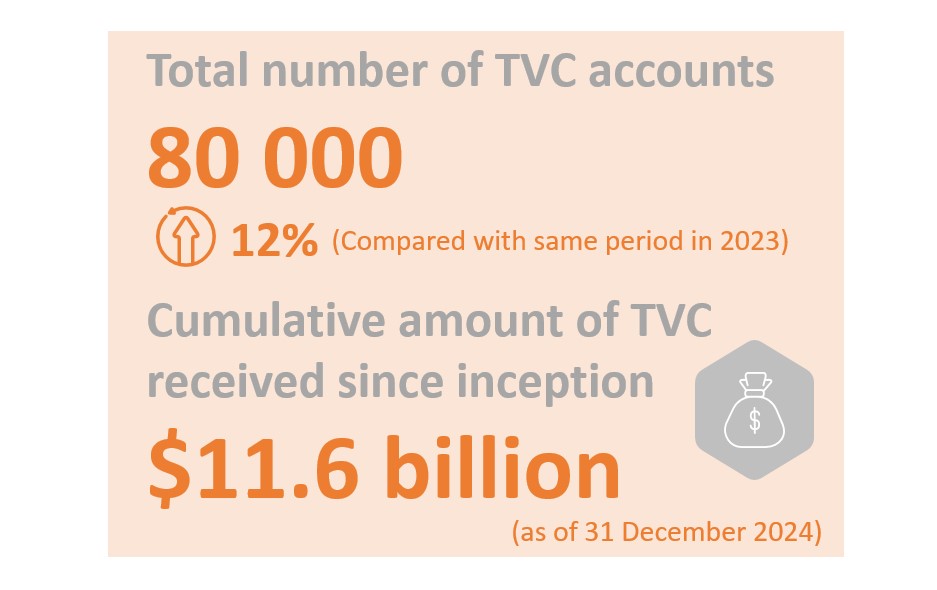

- As at 31 December 2024, the number of tax-deductible voluntary contributions (TVC) accounts was 80 000, reflecting a year-on-year growth of 12%. The cumulative amount of contributions received in such accounts since inception of TVC in April 2019 was $11.6 billion.

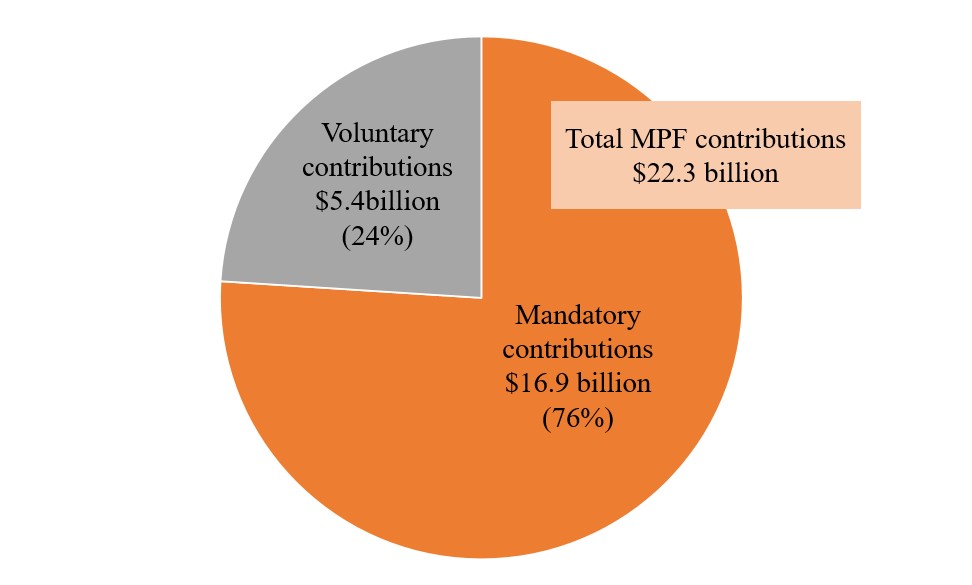

- In the fourth quarter of 2024, the total MPF contributions received amounted to $22.3 billion. Of the total, $16.9 billion (76%) was mandatory contributions and $5.4 billion (24%) was voluntary contributions. The benefits paid amounted to $12.0 billion.

* “Highest” and “Lowest” refer to the highest and lowest annualized net return among individual funds in each fund type during the relevant period respectively.

# Percentages may not sum up to the total due to rounding.

-Ends-

28 February 2025