- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPF System’s annualized return since inception is 4.1% MPFA’s latest Statistical Digest shows

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPF System’s annualized return since inception is 4.1% MPFA’s latest Statistical Digest shows

The annualized rate of return of the Mandatory Provident Fund (MPF) System from its inception in December 2000 to September 2018, after fees and charges, was 4.1%, which was higher than the annualized inflation rate of 1.8% of the same period. The figures are published in the September 2018 Mandatory Provident Fund Schemes Statistical Digest, released today (14 November).

According to the Statistical Digest, the total assets of the MPF System on 30 September 2018 were $858.3 billion. Close to a third, or $245.2 billion, was net investment returns.

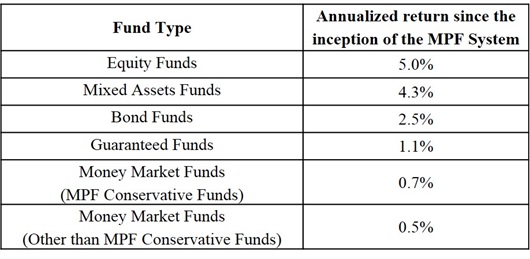

The Statistical Digest also shows that the major types of funds recorded an annualized return of between 0.5% and 5% since the inception of the System:

A spokesperson for the Mandatory Provident Fund Schemes Authority (MPFA) said the Authority is aware that the recent volatility of the global and Hong Kong equity markets has made some scheme members jittery about their MPF investments. However, scheme members should note that the MPF is a 30- to 40-year investment, and the investment returns of their MPF will inevitably be affected by financial market cycles.

"In general, scheme members can withdraw their MPF benefits only when they reach the age of 65. They should not be overly concerned about short-term volatility, as this does not mean they will have the same gain or loss for their total MPF investment upon retirement. Even if the market conditions are not favourable when they retire, they may keep their benefits in the MPF System for continuous investment."

The spokesperson said that the amount of MPF benefits each member accumulates in the end depends on many factors, including his investement strategy, when he starts making contributions, how much and for how long he contributes, and when he withdraws his MPF benefits. The reported average monthly gains or losses per scheme member should be treated with caution, as the average figures do not take into account the circumstances of each member.

The spokesperson added, "Scheme members are encouraged to take good care of their MPF investments, but should remain calm and rational in the face of market volatility. When deciding how to allocate their MPF assets, they should consider factors such as their risk tolerance level and the life stage they are at, and should not try to time the market."

"It is also important for scheme members to look at the risk level, not just the return, of a particular fund. Diversification into different regions or asset classes is a way to reduce investment risk," the spokesperson said.

To help scheme members make informed investment decisions, the MPFA has various tools available on different platforms to provide scheme members with relevant information. For example, the Fund Performance Platform, which is a one-stop platform launched early this year, helps scheme members review funds from different perspectives.

The Statistical Digest, which is published quarterly, is available on the MPFA website.

For more MPF investment information, please click here.

-Ends-

14 November 2018