- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA issues 2018 MPF System investment performance report

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA issues 2018 MPF System investment performance report

The Mandatory Provident Fund Schemes Authority (MPFA) released a report titled Investment Performance of the MPF System in 2018 today (28 February). As at the end of December 2018, the total assets of the Mandatory Provident Fund (MPF) System were $813 billion. The annualized rate of return since the inception of the MPF System was 3.2%.

Of the total assets, about 23%, or $186.1 billion, was investment returns net of fees and charges.

An MPFA spokesperson reminded scheme members that, “It was impossible for investors to accurately predict market conditions consistently. Scheme members should not try to time the market. Despite occasional downturns in the global economy and financial markets, the MPF System has demonstrated resilience over the years.”

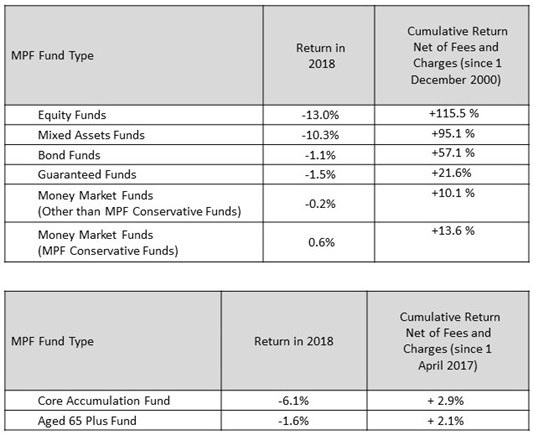

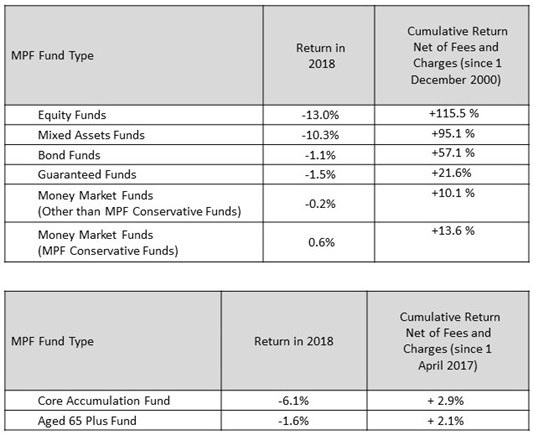

Since the inception of the MPF System to 31 December 2018, funds of all fund types on average have recorded a positive cumulative return of 10.1% to 115.5% net of fees and charges. Both the Core Accumulation Fund and the Age 65 Plus Fund under the Default Investment Strategy (DIS) recorded average cumulative returns of 2.9% and 2.1% net of fees and charges respectively since the launch of the DIS on 1 April 2017.

The spokesperson reiterated that, the MPF is a long-term investment for retirement, spanning 30 to 40 years, so it is inevitable that there will be volatilities in the financial markets over such a long period. Scheme members are advised to regularly review and actively manage their MPF investment. They should remain calm and far-sighted in the face of market volatility. Members should also take into account their stage of life, investment objectives and risk tolerance level, and adjust their investment portfolio if needed.”

Since the assets in MPF System are invested in financial products, fluctuations in the equity, bond and money markets have a direct impact on the performance of the MPF System. Over 60% of MPF assets are invested in equity markets at present. Scheme members are encouraged to consider diversifying their investment risk. The DIS automatically reduces investment risk according to a member’s age; fee are cappedat 0.95%; and it adopts a globally diversified investment approach, which is an appropriate investment option for retirement savings.

-Ends-

28 February 2019

Of the total assets, about 23%, or $186.1 billion, was investment returns net of fees and charges.

An MPFA spokesperson reminded scheme members that, “It was impossible for investors to accurately predict market conditions consistently. Scheme members should not try to time the market. Despite occasional downturns in the global economy and financial markets, the MPF System has demonstrated resilience over the years.”

Since the inception of the MPF System to 31 December 2018, funds of all fund types on average have recorded a positive cumulative return of 10.1% to 115.5% net of fees and charges. Both the Core Accumulation Fund and the Age 65 Plus Fund under the Default Investment Strategy (DIS) recorded average cumulative returns of 2.9% and 2.1% net of fees and charges respectively since the launch of the DIS on 1 April 2017.

The spokesperson reiterated that, the MPF is a long-term investment for retirement, spanning 30 to 40 years, so it is inevitable that there will be volatilities in the financial markets over such a long period. Scheme members are advised to regularly review and actively manage their MPF investment. They should remain calm and far-sighted in the face of market volatility. Members should also take into account their stage of life, investment objectives and risk tolerance level, and adjust their investment portfolio if needed.”

Since the assets in MPF System are invested in financial products, fluctuations in the equity, bond and money markets have a direct impact on the performance of the MPF System. Over 60% of MPF assets are invested in equity markets at present. Scheme members are encouraged to consider diversifying their investment risk. The DIS automatically reduces investment risk according to a member’s age; fee are cappedat 0.95%; and it adopts a globally diversified investment approach, which is an appropriate investment option for retirement savings.

-Ends-

28 February 2019