- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- Supplementary information on early MPF withdrawal on the grounds of permanent departure from Hong Kong

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

Supplementary information on early MPF withdrawal on the grounds of permanent departure from Hong Kong

It has come to the MPFA’s attention that various media reports have recently cited the MPFA Annual Report 2020-21 (financial year) for the figures of MPF withdrawal on the grounds of permanent departure (PD) from Hong Kong, including the year-on-year increase of the claim amount. In this connection, the MPFA would like to provide the following supplementary information to facilitate a comprehensive understanding of the issue.

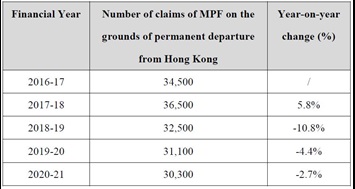

- According to the statistical information on the number of PD claims in the past five financial years* provided by MPF trustees, the number of claims in the three most recent financial years all recorded a year-on-year drop. Please refer to the table below for details.

*The MPFA started collecting the related figures in 2016.

- While the total amount of MPF withdrawn on PD grounds in the financial year 2020-21 recorded an increase of 27.3% year on year, it should be noted that the total MPF assets as at the end of financial year 2020-21 had increased by 35% over that as at the end of the preceding financial year to around $1.17 trillion. The increase in the total MPF assets, which was largely attributed to the positive MPF investment returns during the period and the continuous inflow of contributions, also contributed to the increase in the amount of PD claims in tandem. According to the statistics, the $6.6 billion of PD claims in the financial year 2020-21 accounted for 0.56% of the total MPF assets of around $1.17 trillion as at the end of the 2020-21 financial year.

- The MPFA reiterates that PD claimants may not be emigrants. PD claims also include claimants returning to their places of origin (e.g. non-local employees who have completed their employment in Hong Kong), and claimants moving to reside in the Mainland. Given that an MPF member may be holding more than one account under the MPF System and make individual claims with trustee(s) for withdrawing his/her MPF in these accounts, the number of claimants involved is estimated to be less than that of claims.

-End-

17 August 2021