- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - Make use of DIS for better MPF management in the New Year

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - Make use of DIS for better MPF management in the New Year

Mrs Lau said that, since the inception of the DIS in April 2017, the number of MPF accounts investing in the DIS has grown steadily. As of September 2022, about 2.8 million MPF accounts, equivalent to one in every four accounts, were investing in the DIS, an increase of about 10.3% from the previous year. Investments in the DIS amounted to $76.8 billion, which accounted for 8% of total MPF net asset value.

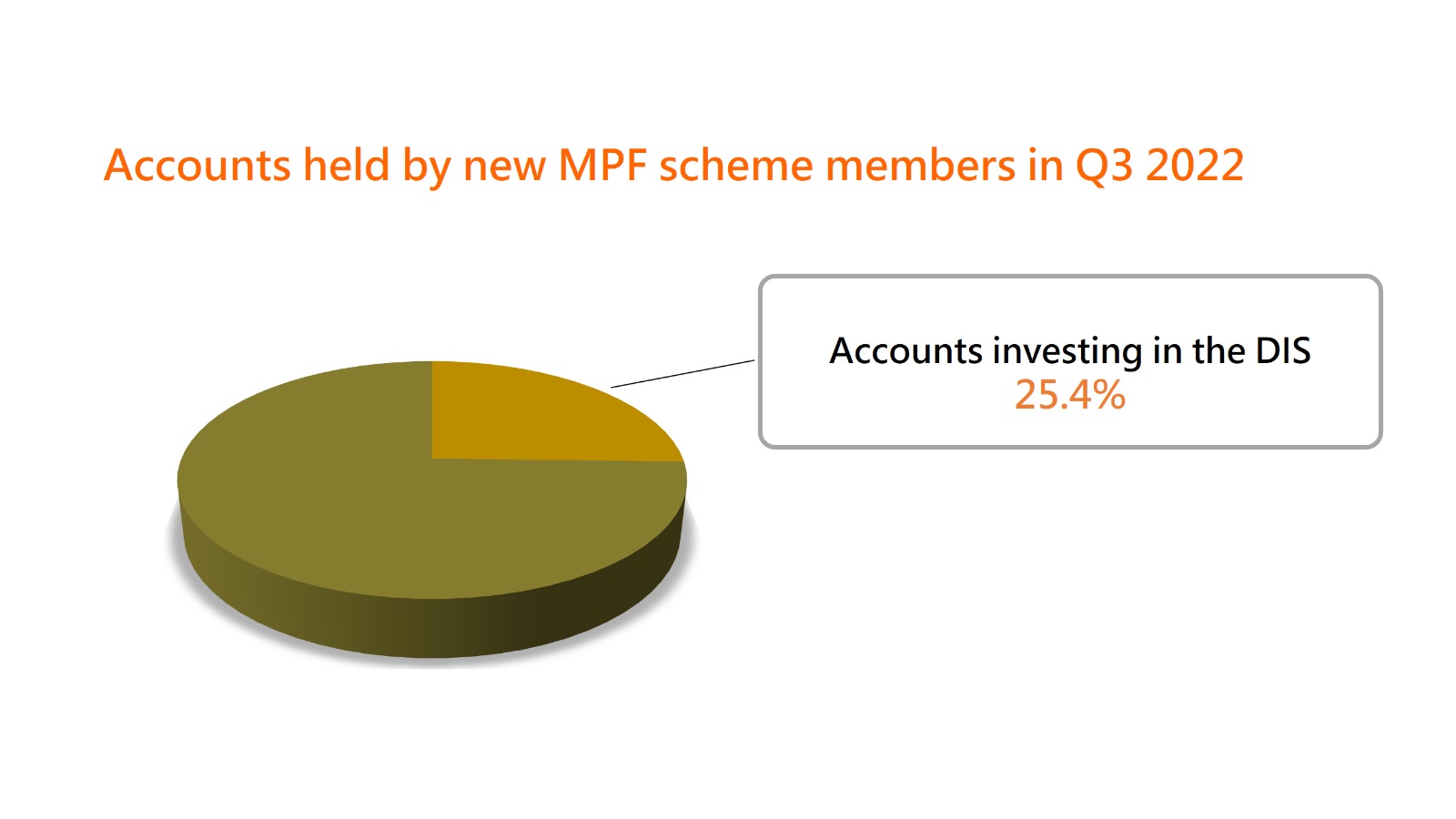

According to MPFA’s latest figures, in Q3 2022, 25.4% of MPF accounts held by new scheme members were investing in the DIS. Among them, over 65% actively chose the DIS, indicating that not only had the DIS served those scheme members who have not given any specific investment instructions to their MPF trustees, but its features (fee caps, a diversified investment approach and automatic de-risking) were attractive to and well-received by a considerable number of scheme members.

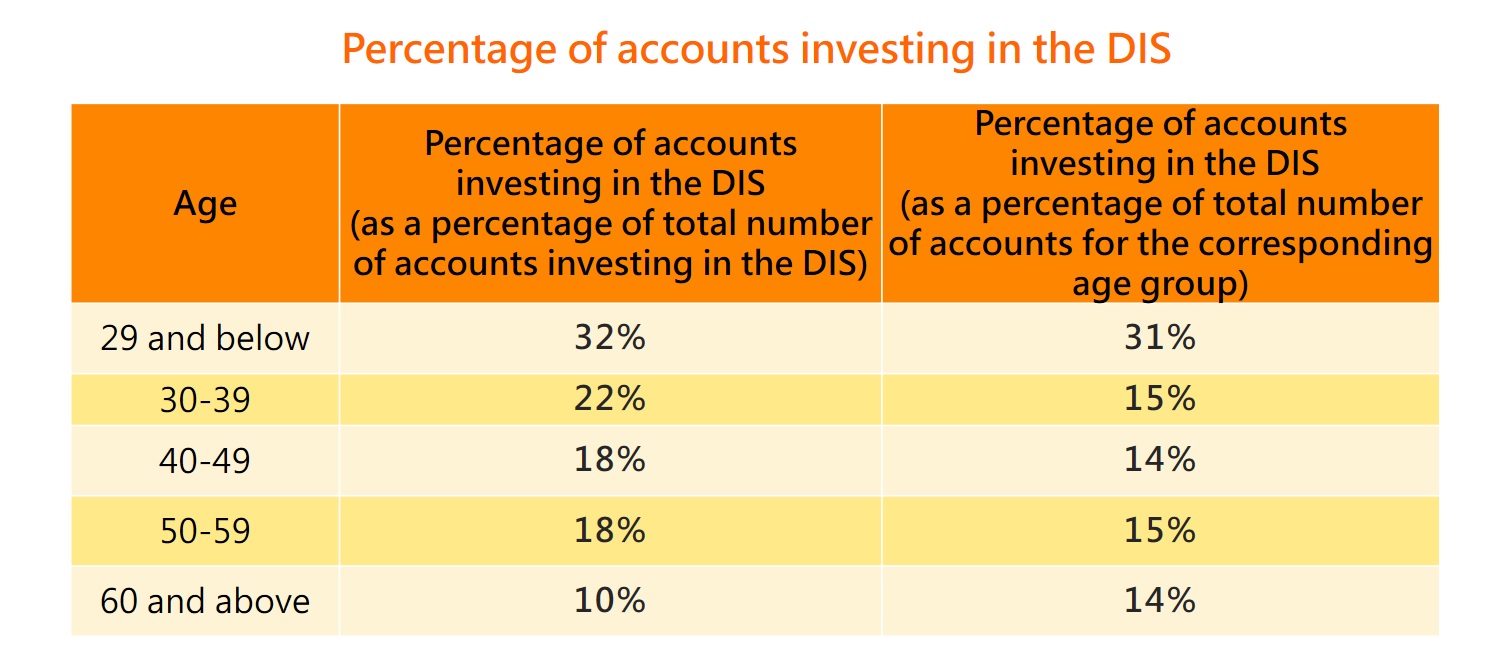

The number of MPF accounts investing in the DIS was higher among younger scheme members, with 32% of them held by scheme members aged 29 and below, 22% held by those aged 30 to 39, 18% held by those aged 40 to 49, 18% held by those aged 50 to 59, and 10% held by those aged 60 and above. Out of all MPF accounts held by scheme members aged 29 and below, 31% of them invested in the DIS which is the highest percentage among all age groups. This shows the popularity of the DIS among younger scheme members.

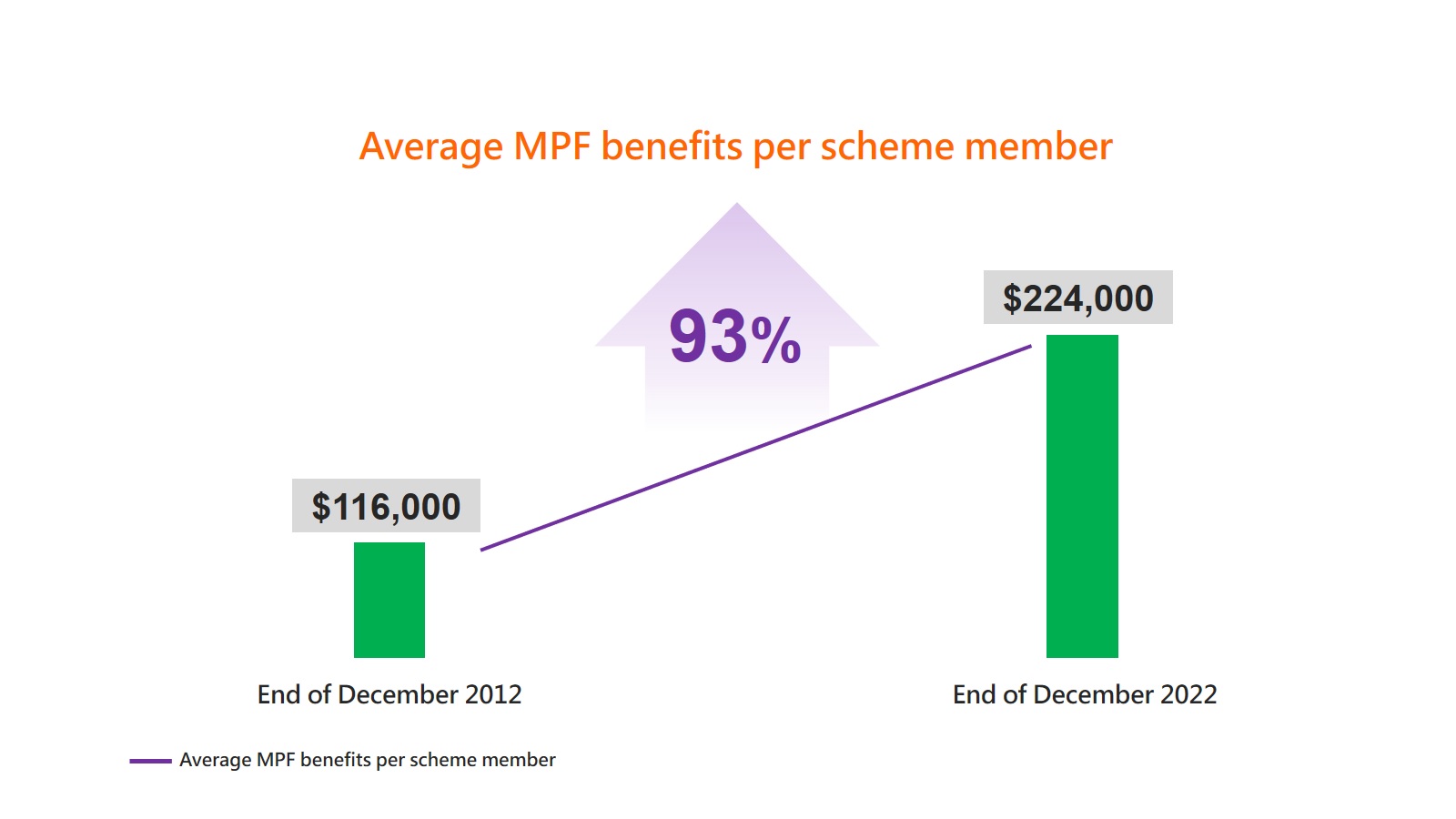

Mrs Lau added that the asset size of the MPF has been expanding over the past 22 years since its inception. As at the end of December 2022, total MPF assets amounted to about $1.05 trillion, up by 139% from 10 years ago. This indicates that the MPF System has achieved the purpose of asset accumulation from the compounding effect of long-term investment through regular contributions made by employers and employees as well as investment returns. As at the end of December 2022, the average amount of MPF benefits per scheme member was $224,000, an increase of 93% from $116,000 as at the end of 2012.

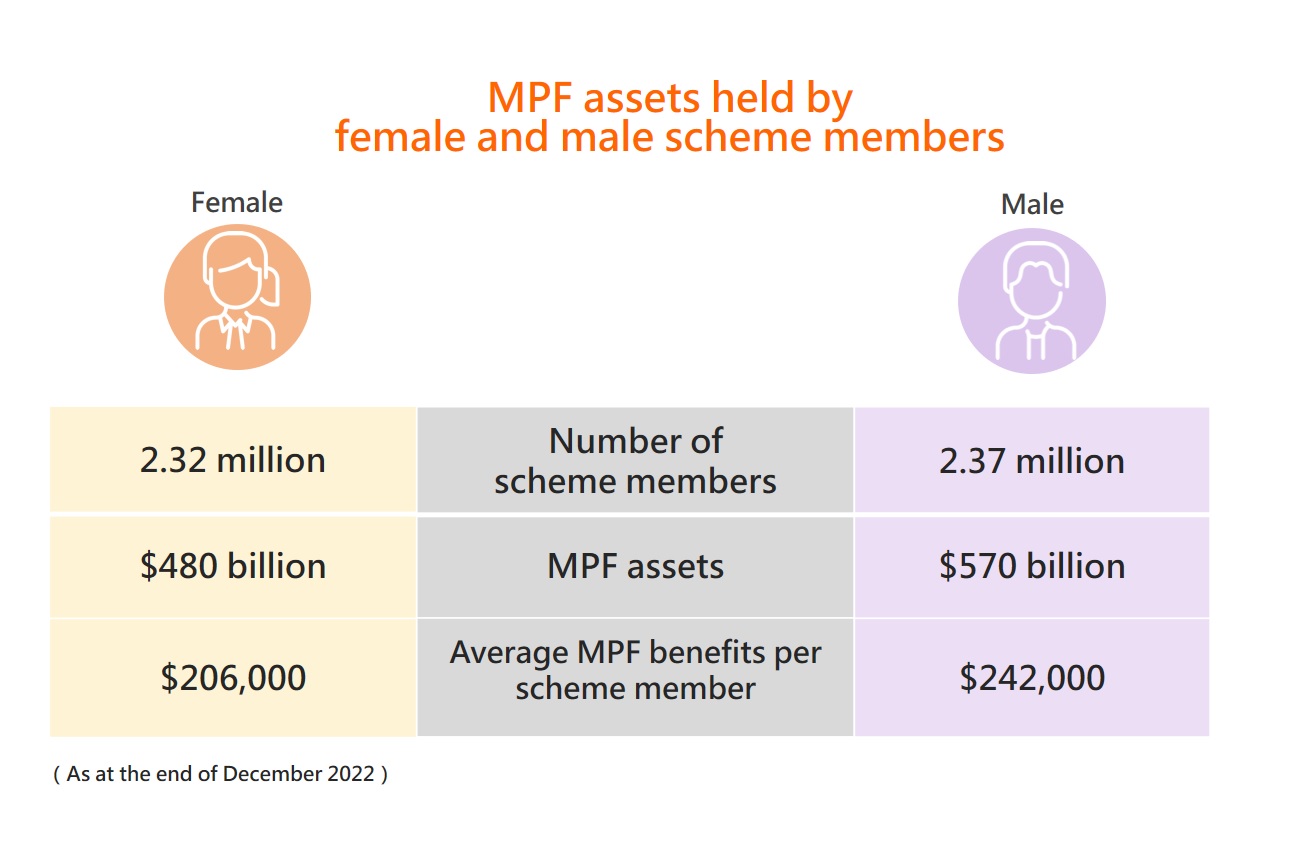

According to MPFA figures, as at the end of December 2022, there were 2.32 million female and 2.37 million male scheme members, with MPF assets of about $480 billion and $570 billion respectively. A female scheme member had an average amount of MPF benefits of $206,000, while a male scheme member had an average of $242,000.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

29 January 2023