- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - Enhancing retirement protection in response to ageing population

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - Enhancing retirement protection in response to ageing population

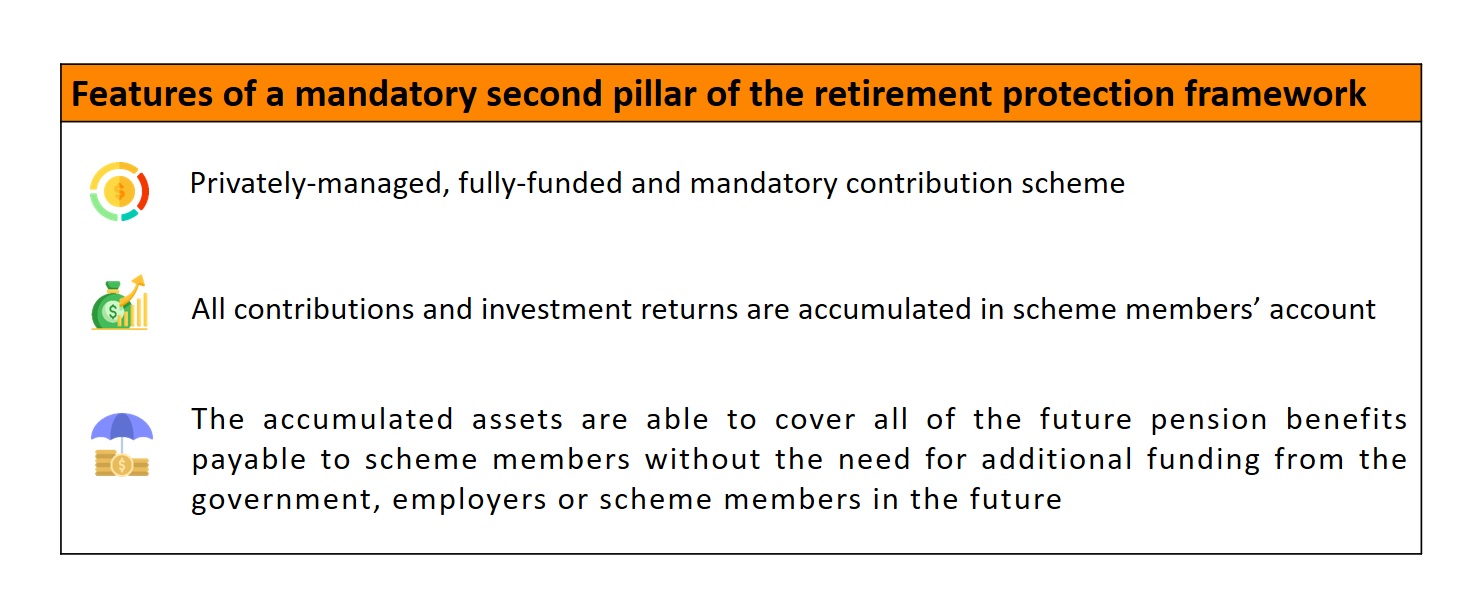

In her blog post published today (26 March), MPFA Chairman Mrs Ayesha Macpherson Lau said that as the mandatory second pillar system of the multi-pillar retirement protection framework recommended by the World Bank, MPF is a mandatory fully-funded contribution scheme. The accumulated assets are able to cover all of the future pension benefits payable to scheme members without the need for additional funding from the government, employers or scheme members in the future. It is financially sustainable without resulting in a heavier burden on the younger generation due to population ageing. The MPF System also shoulders the function of the voluntary third pillar (i.e. voluntary savings), which would further strengthen retirement protection for scheme members by encouraging voluntary contributions in addition to mandatory contributions.

According to the provisional estimate as at end 2022, about 1.57 million of the population was aged 65 or above, accounting for over 20% of the total population in Hong Kong. Mrs Lau pointed out that many individuals who are beyond the traditional retirement age remain both willing and capable of continuing to work, while more employers value their experience and are willing to retain these mature employees.

Currently, an employer can claim a tax deduction for MPF contributions made for an employee, as long as it does not exceed 15% of the total emoluments of the employee. In 2022, about 12,500 employers made voluntary MPF contributions for about 21,400 employees aged 65 or above, amounting to a total of about $353 million.

The 2023-24 Budget Speech delivered by the Financial Secretary proposed increasing the tax deduction for MPF voluntary contributions made by employers for their employees aged 65 or above from the current 100% to 200%. Under this proposal, if an employer makes a voluntary MPF contribution for an employee aged 65 or above at a contribution rate of 5% of the employee’s monthly earnings of $15,000, the deduction in respect of the employer’s voluntary MPF contribution as outgoings or expenses when calculating assessable profits will be increased from $9,000 to $18,000 (i.e. $15,000 x 5% x 12 x 200%). Assuming a profits tax rate of 16.5% for the employer, this would result in additional tax savings of about $1,500 during the year, with total tax savings of $2,970 (i.e. $18,000 x 16.5%).

Mrs Lau said the proposal is a triple-win solution, as it would help increase the retirement savings for silver-haired working population, provide extra tax incentives for employers who are willing to make voluntary contributions, and help release potential labour force. She said that the MPFA will render full support to the Government in formulating the implementation details and executing the proposed measure.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

26 March 2023