- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - Sparing no effort to protect the MPF rights of employees

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - Sparing no effort to protect the MPF rights of employees

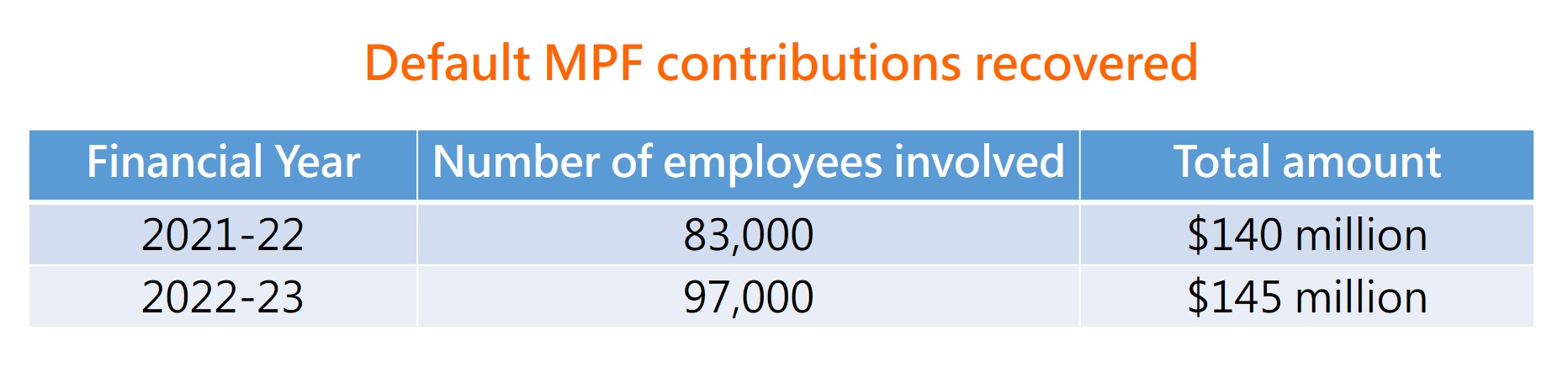

In the 2021-22 financial year, the MPFA successfully recovered about $140 million in default contributions for over 80,000 employees, whereas in 2022-23, $145 million in default contributions were recovered for over 90,000 employees.

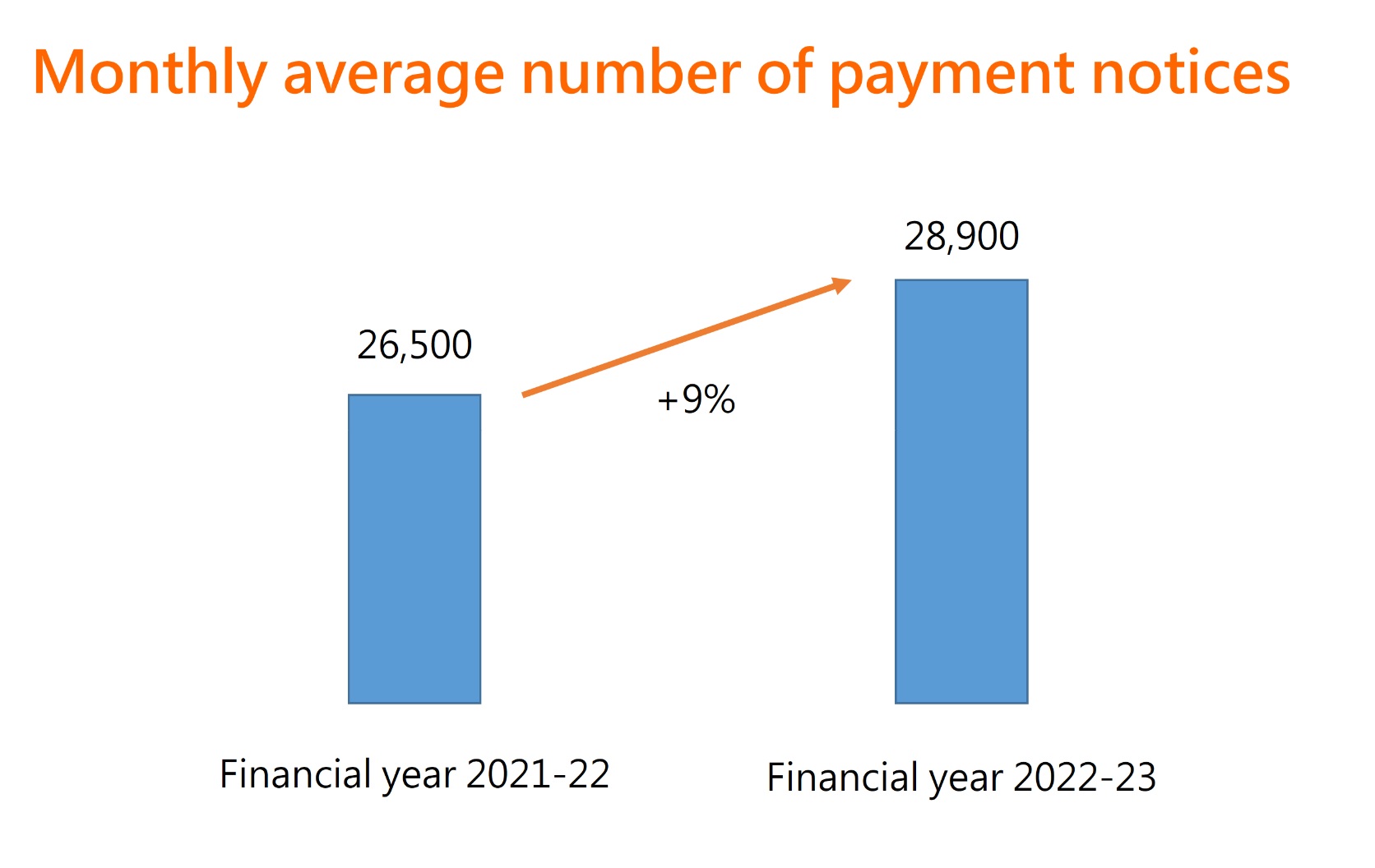

Over the past two years, the number of payment notices issued by the MPFA to defaulting employers had risen. In the 2021-22 financial year, about 320,000 payment notices were issued with a monthly average of 26,500 payment notices. The number of payment notices issued in the 2022-23 financial year issued had increased by 9% to 350,000, or a monthly average of 28,900. Since Hong Kong is resuming to full normalcy and the economy is anticipated to improve continually, Mrs Lau expected that the rising trend of the number of payment notices will be reversed.

Mrs Lau said in the blog post that once a non-compliant case is identified, the MPFA would serve a payment notice requiring the defaulting employer to pay the arrears as well as a contribution surcharge at a rate of 5% of the arrears. The amount of arrears and contribution surcharge recovered will be fully credited to the account of the employees. However, not all employers pay the default contributions and surcharges within the payment period specified in the payment notice. In the 2022-23 financial year, only about 30% of employers settled the arrears and contribution surcharge fully by the deadline (i.e. within 14 days from the issue of payment notice).

With a view to addressing the above issue as well as further strengthening deterrence, Mrs Lau said that the MPFA is studying legislative amendment to enhance the current mechanism by implementing a tiered surcharge arrangement. Under the current legislation, regardless of how long the delay in rectifying the default contribution by an employer, surcharge at a flat rate of 5% is imposed. Under the tiered surcharge arrangement being studied, if the non-compliant employer does not rectify the arrears and surcharge by a specified period, the surcharge amount will increase accordingly. The aim is to urge the defaulting employers to settle the arrears and surcharge earlier, thus enhancing the protection of employees’ MPF rights.

Mrs Lau added that the MPFA has always adopted a proactive approach in following up MPF non-compliant cases on various fronts. In the 2022-23 financial year, over 90% of the default contribution cases handled by the MPFA were attributed to the monthly default contribution reports submitted by MPF trustees, which enabled the MPFA to take prompt follow-up action, even before the affected employees noticed the default contributions or lodged a complaint.

The eMPF Platform, which is currently under construction will significantly improve the efficiency of the MPFA’s enforcement action. Once the Platform is in full operation, the MPFA will be able to monitor the contribution status of employers more closely and directly, which will expedite the handling of non-compliant cases. Employees will also be able to check the status of payment of contributions by their employers anytime anywhere via the Platform and take appropriate follow-up action as necessary.

In the meantime, Mrs Lau said she was pleased to learn that the Government had announced 1 May 2025 as the effective date of the abolition of the offsetting arrangement which can solidify the MPF System and strengthen the retirement reserves of the working population. The MPFA will fully support the Government in implementing the relevant measures.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

30 April 2023