- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - Review MPF regularly with long-term investment as the goal

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - Review MPF regularly with long-term investment as the goal

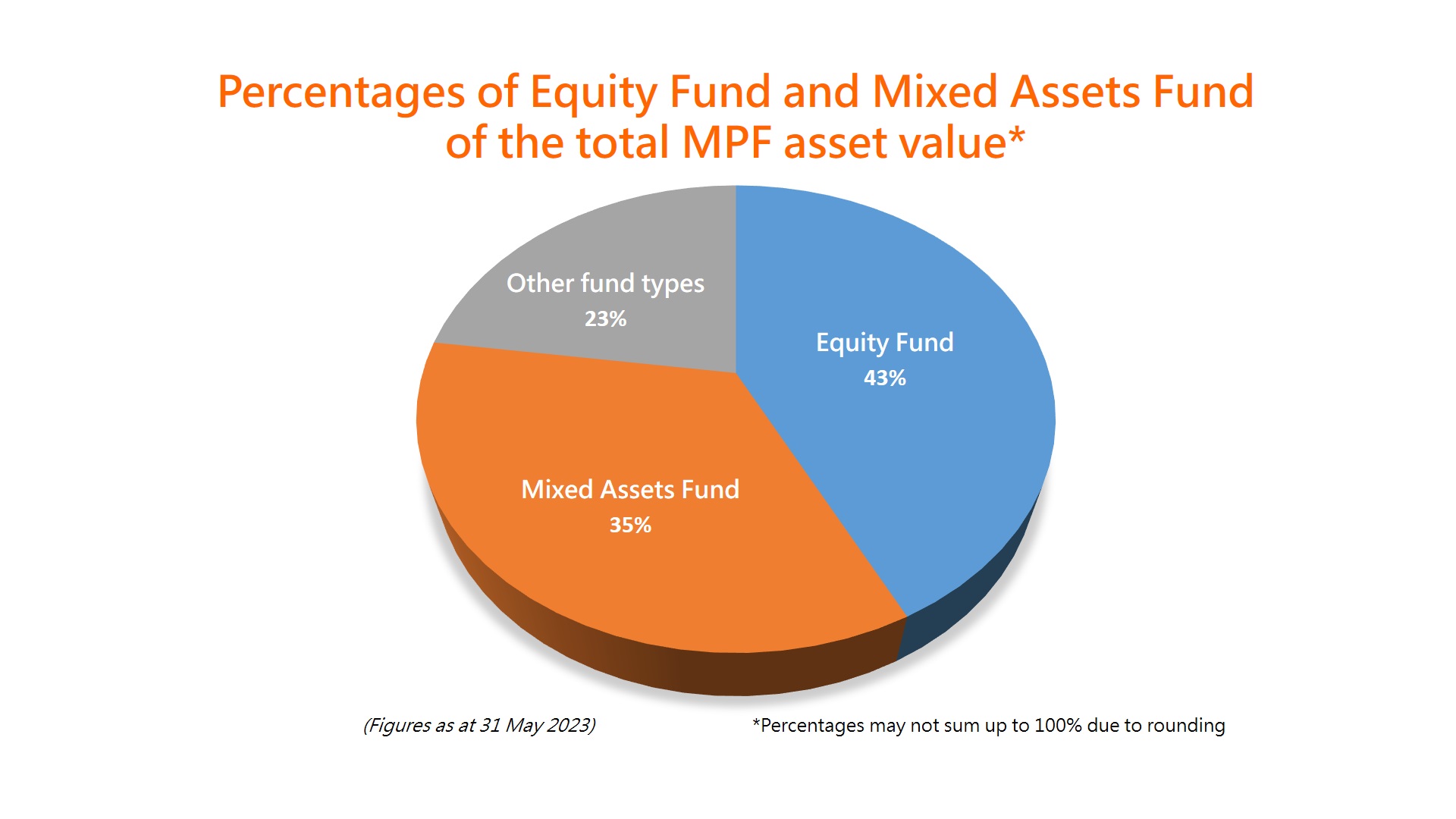

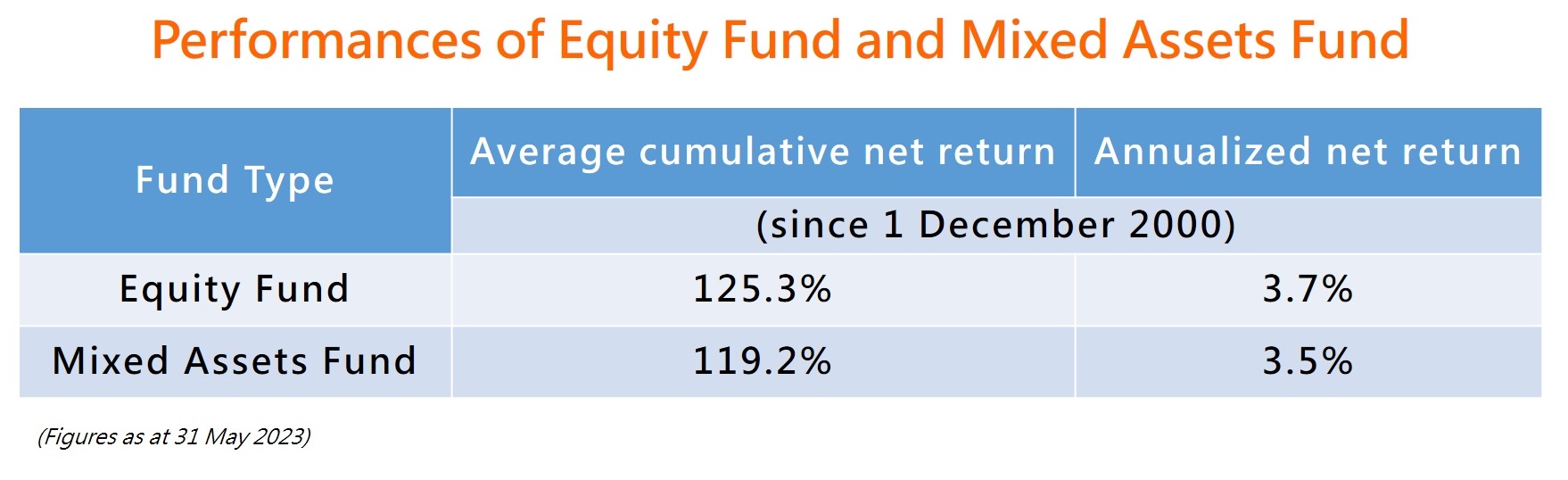

Since the inception of the MPF System on 1 December 2000, the long-term performances of all MPF fund types have recorded positive returns, helping to add value to employees’ retirement reserves. Among different fund types, the best performers are Equity Fund and Mixed Assets Fund, which account for nearly 80% of the total MPF asset value. These two fund types registered an average cumulative net return of 125.3% and 119.2% respectively since the inception of the MPF System up to 31 May 2023.

Mrs Lau reminded employees that while growth funds may have the potential to generate higher investment returns, they come with greater investment risk. Employees should therefore choose funds that fit their personal investment goals according to their life stage and risk-tolerance level. Young employees with a longer investment horizon to withstand short-term market volatility and with a higher risk-tolerance level may consider choosing growth funds and leveraging on the advantages of the compounding effect on returns.

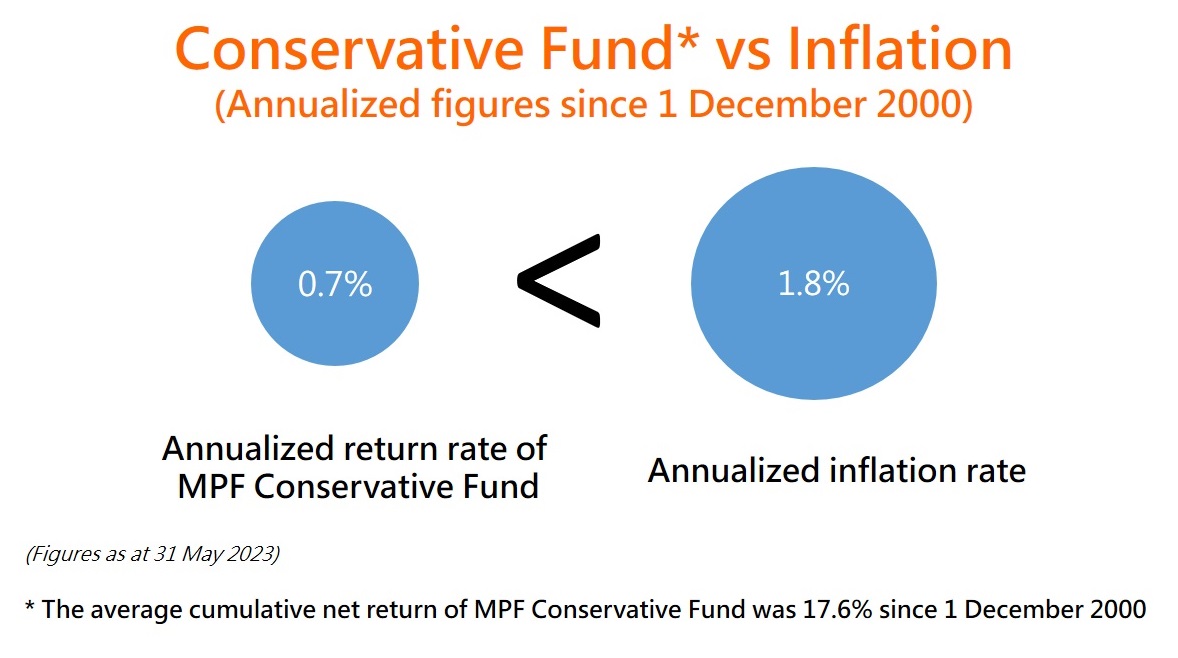

MPF Conservative Fund is generally invested in Hong Kong-dollar assets, either short-term bank deposits or short-term bonds. Its investment risk is relatively low and so is its expected return. In the long run, the return of this fund type may not be able to beat inflation. For employees who are farther away from retirement, MPF Conservative Fund would not be a suitable investment choice.

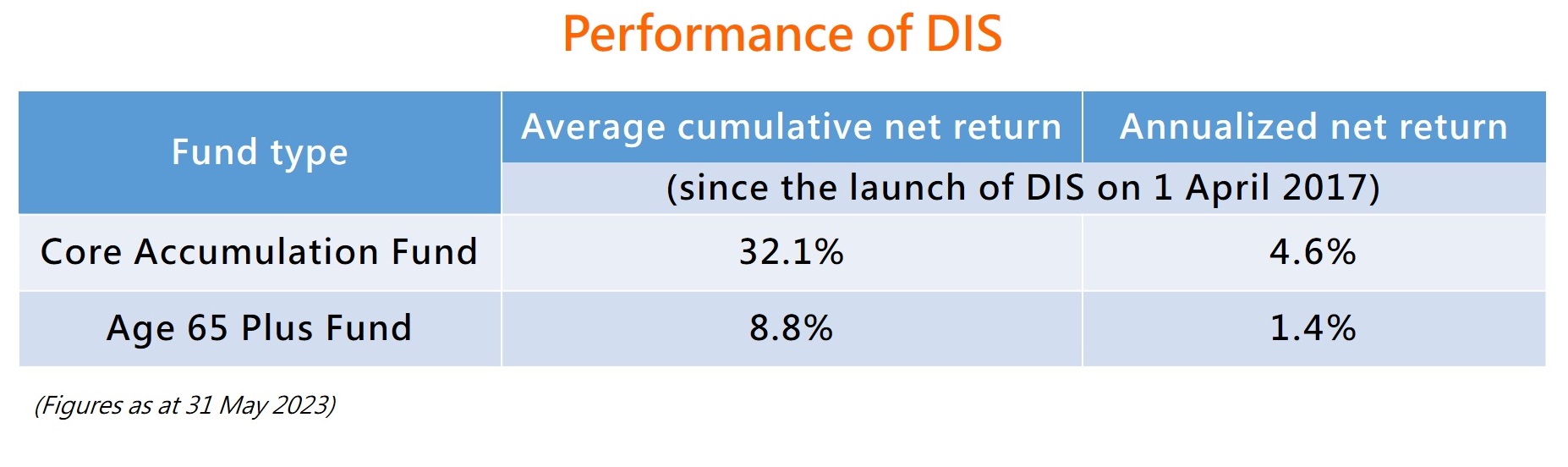

Mrs Lau urged employees not to switch funds because of short-term market fluctuations so as to avoid “buying high, selling low”. Employees should bear in mind that diversification of investment can help reduce the risk of an investment portfolio. For those who are unfamiliar with investing or have no time to manage their MPF, they may consider choosing the default investment strategy (DIS). As at end May 2023, the Core Accumulation Fund 1 and Age 65 Plus Fund 2 under the DIS had achieved average cumulative net annualized returns of 32.1% and 8.8% respectively, since their launch on 1 April 2017. Their annualized net returns were 4.6% and 1.4% respectively.

The DIS features “automatic de-risking”, whereby the proportion of investment between equities and bonds is gradually and automatically adjusted every year once employees reach the age of 50. It is suitable for long-term investment as it helps reduce employees’ exposure to investment risk when approaching retirement age. The DIS invests in both global equities and bonds, which helps diversify risks across regions and asset classes. Coupling with the fee cap, the DIS combines the merits of both growth and defensive strategies.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

1. Core Accumulation Fund: 60% of the assets of the fund are invested in higher-risk assets (mainly global equities), and the rest are invested in lower-risk assets (mainly global bonds). This fund type accounts for approximately 75% of assets invested in the DIS.

2. Age 65 Plus Fund: 20% of the assets of the fund are invested in higher-risk assets (mainly global equities), and the rest are invested in lower-risk assets (mainly global bonds).