- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA Blog - Increase retirement reserves sooner rather than later

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA Blog - Increase retirement reserves sooner rather than later

Launched in 2019, the Tax-deductible Voluntary Contributions (TVC) is intended to encourage the working population, by offering a tax incentive, to make additional MPF contributions to enhance their retirement reserves so as to better prepare for their expenses in their retirement life. Scheme members who make TVC can enjoy a tax deduction under the salaries tax or tax under personal assessment. The tax deductible limit is $60,000 per year, which is an aggregate limit for both TVC and qualifying deferred annuity policies premiums. The tax concession is up to $10,200 per year based on the highest tax rate of 17%.

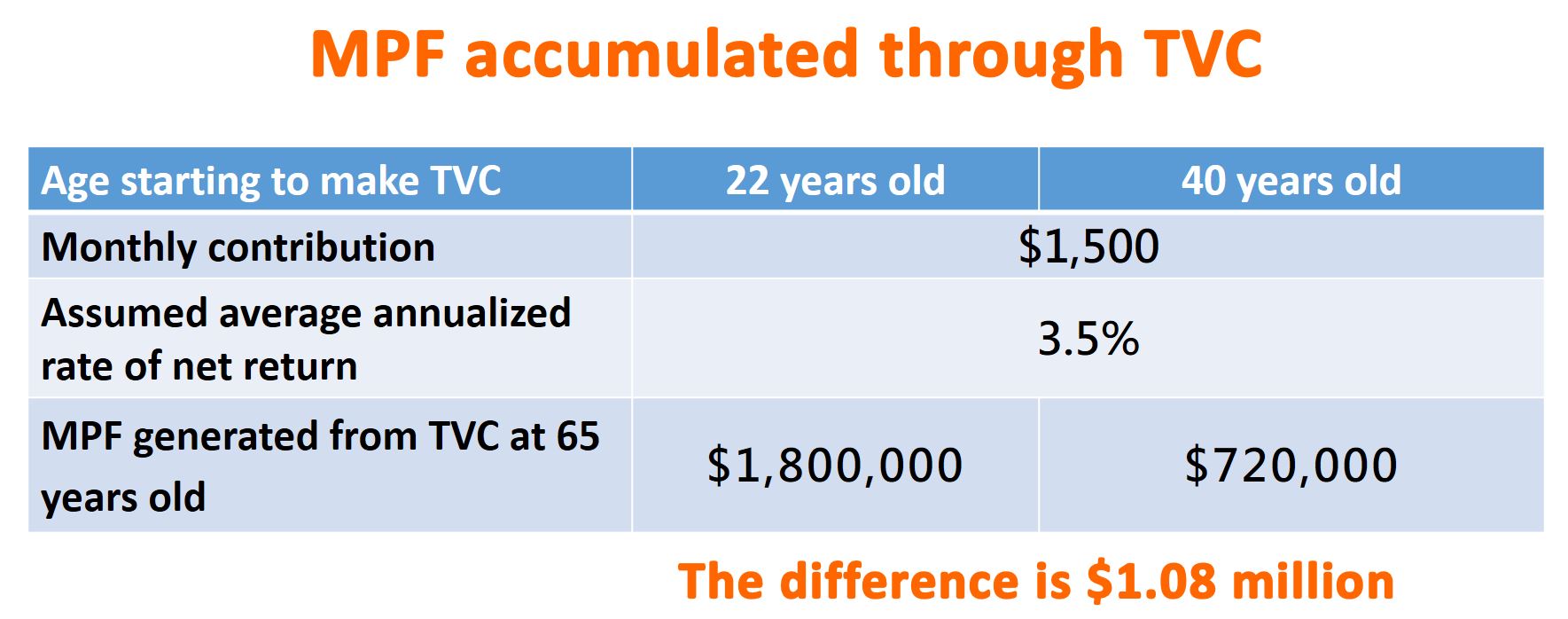

The compounding effect is more prominent with a longer time horizon if one starts making voluntary contributions earlier, said Mrs Lau. If a scheme member starts to make a monthly TVC of $1,500 (i.e. equivalent to saving $18,000 per year, or a net actual payment of $14,940 taking into account enjoyment of a tax reduction of $3,060, assuming the highest tax rate of 17%) from the beginning of his/her work life at 22 years old, assuming an average annualized rate of net return of 3.5%1, it is estimated that nearly $1.8 million2 of MPF could be accumulated from TVC when he/she reaches the retirement age of 65. If that scheme member starts making the same monthly TVC only from the age of 40, the estimated MPF accumulated from TVC would be around $0.72 million, and it is $1.08 million less than the previous example. This highlights the benefit of making additional voluntary contributions as early as possible.

The TVC has been in place for more than four years, and the number of TVC accounts has steadily increased. As at 30 September this year, there were 70,000 TVC accounts, an increase of 10% year on year, and 67% higher than that three years ago in September 2020. From the launch of TVC to September 2023, the cumulative amount of TVC received is $9.2 billion.

In addition to tax incentives, TVC offers flexibility in making contributions in that a scheme member may adjust the contribution amount and frequency according to one’s personal financial status. In addition to the regular monthly contribution approach, a scheme member may use his/her year-end bonus to make TVC in a lump sum. Approximately three-quarters of TVC accounts use a flexible contribution approach, i.e. in either a lump sum or multiple contributions.

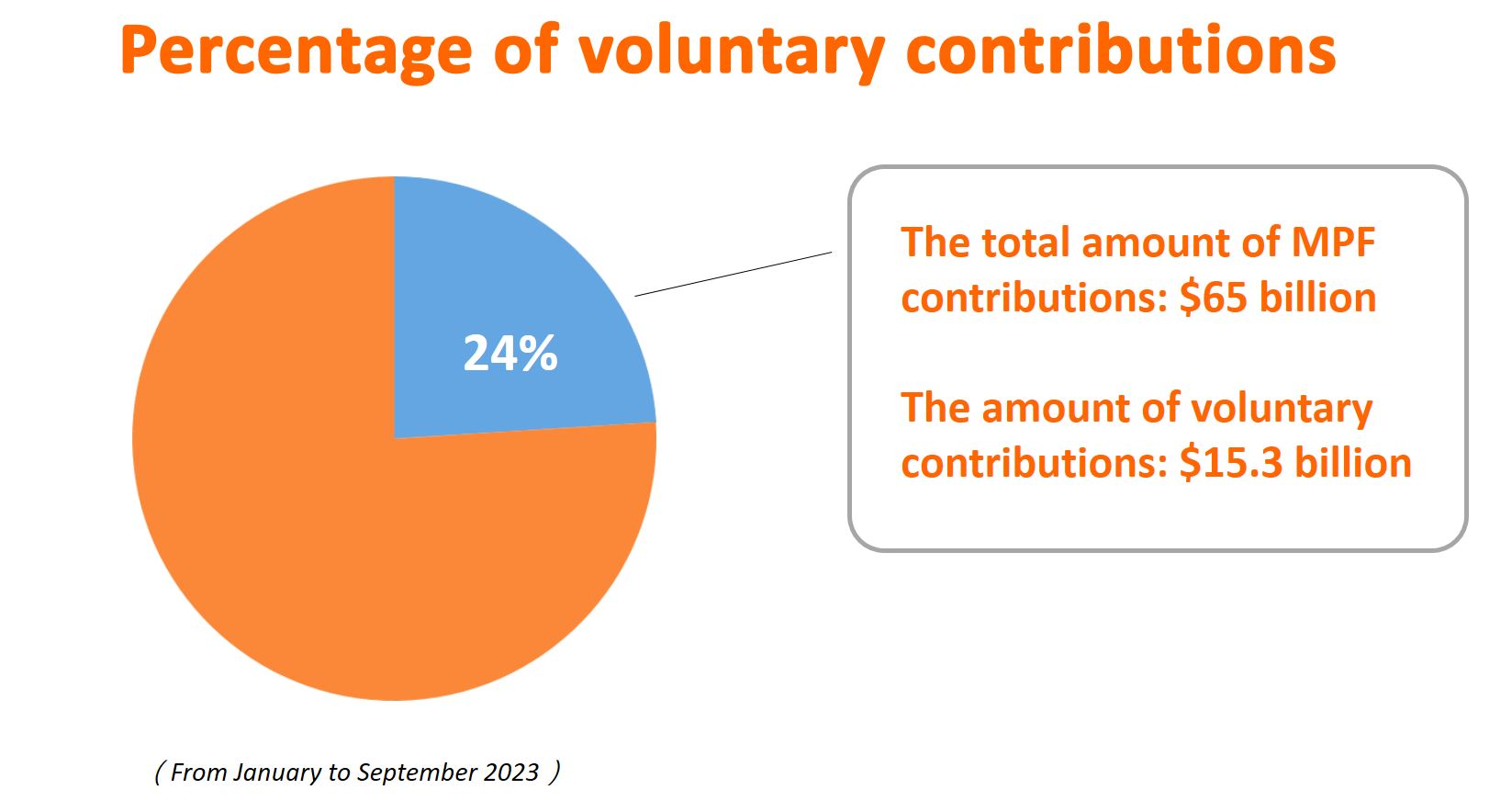

Mrs Lau also highlighted the significant role of employers in enhancing their employees’ retirement protection. In the first nine months this year, out of the total MPF contributions of $65 billion, $15.3 billion (or 24%) were voluntary contributions, 78% of which were voluntary contributions paid by employer. The total amount of voluntary contributions, which was $1.7 billion in the first nine months of 2004 when the statistics were first collected, had increased by eight times to $15.3 billion in the first nine months of 2023.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

26 November 2023

1. Assuming that scheme member invests in mixed assets funds. Since the inception of the MPF System to September 2023, the average annualized net return (fees and charges deducted) of mixed assets funds was 3.5%.

2. The related estimation of the MPF is a future value, which does not reflect the impact of inflation. The example is for illustration only and does not imply the actual value of the MPF generated by making TVC.