Info Center

Press Releases

MPFA blog - Saluting women in Hong Kong!

MPFA Chairman Mrs Ayesha Macpherson Lau published her latest blog post today (7 March), on the eve of the International Women’s Day, to look into retirement protection planning from the perspective of women.

Mrs Lau pointed out that according to figures from the Census and Statistics Department, the average life expectancy for females in Hong Kong is 87.9 years, which is 5.4 years longer than that for males, suggesting that females need larger retirement reserves to support a longer retirement life.

She added that despite having a longer average life expectancy than males, the average length of females’ participation in the workforce is shorter than that of males. The labour force participation rate of females aged 25 to 39 is 81%, whereas that for males is 93%. However, in the age group of 40 to 64, the disparity in the labour force participation rate between females (64%) and males (82%) is wider than the abovementioned age group, indicating that female employees may leave the workforce earlier. She specially reminded that the shorter working life would significantly affect women’s considerations regarding retirement protection planning.

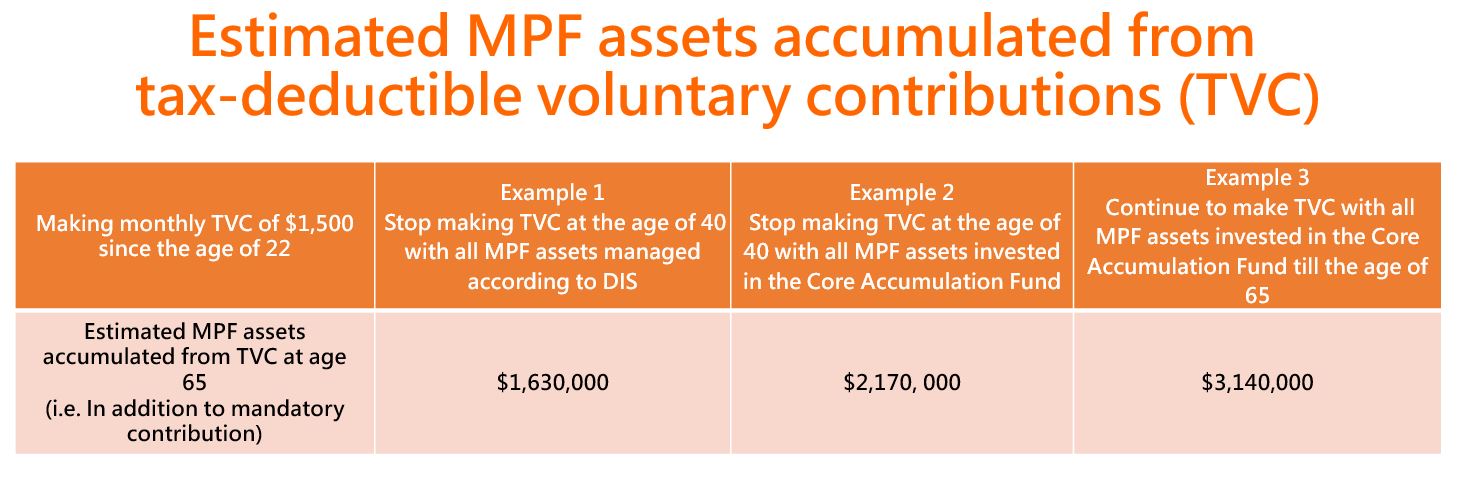

Mrs Lau recommended that women should more proactively make use of MPF for retirement protection planning from the early stage of their working life, and encouraged them to make tax-deductible voluntary contributions (TVC). As an illustration, a female scheme member starts making monthly TVC of $1,500 at the age of 22 and invests it according to the default investment strategy (DIS). Assuming that she exits the workforce at the age of 40, her MPF assets accrued from TVC would be kept investing in the Core Accumulation Fund (CAF) according to DIS. When she reaches the age of 50, the “automatic de-risking” function will kick in, meaning that every year her holdings in the CAF will be progressively reduced, and her holdings in the Age 65 Plus Fund (A65F) will be increased correspondingly. Based on the average annualized rate of net return of 5.5% of the CAF and 1.9% of the A65F since their inception, it is estimated that she would additionally accumulate $1.63 million1 from TVC when she withdraws her MPF at the age of 65.

Apart from investing according to DIS, MPFA figures show that some scheme members have proactively invested in CAF as a fund choice. If that female scheme member chooses to invest TVC in CAF according to her own investment objective and risk appetite, and continues to keep the assets in CAF after exiting the workforce at the age of 40, it is estimated that she would additionally accumulate $2.17 million1 when she withdraws her MPF at 65.

More MPF will be accumulated if a scheme member makes TVC continuously for a longer period. In the last example, if the female scheme member continues to work and make TVC until her retirement at the age of 65, it is estimated that she would additionally accumulate $3.14 million1.

As at the end of 2023, approximately 31,000 TVC accounts were held by females, 25% fewer than those of males. Before the age of 40, a stage in which females have a higher labour force participation rate, there is a similar disparity: among scheme members in the age group of 20 to 39, females and males held 6,000 and 8,200 TVC accounts respectively, i.e. the number of TVC accounts held by females were 27% fewer than those held by males.

In contrast, in the older age groups, more females held TVC accounts, and the difference between the number of TVC accounts held by females and males considerably narrowed. For example, in the age group of 45 to 54, there were 9,700 TVC accounts held by females, which were only about 11% fewer than the 10,900 TVC accounts held by males. If the employment population figures of both genders in that age group are taken into account, the number of TVC accounts per thousand employed females and males was quite close. This suggests that more mature female scheme members may tend to be more active in planning for their retirement protection.

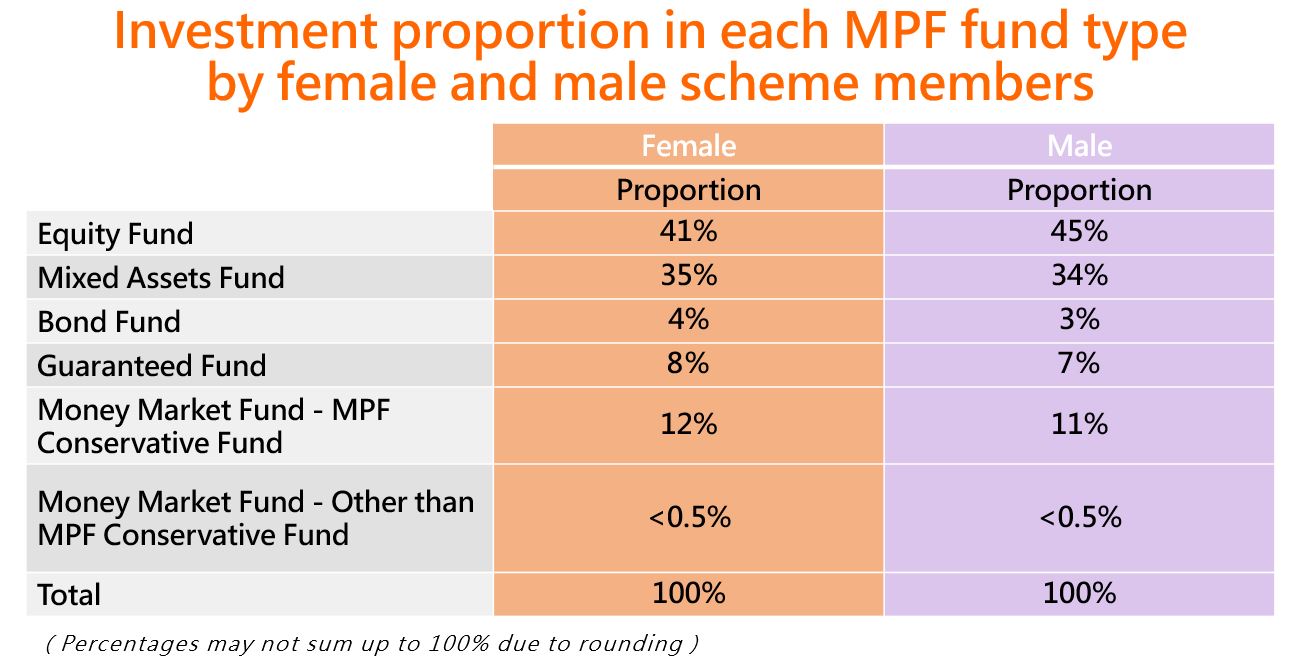

While a study2 by The Organisation for Economic Co-operation and Development showed that the investment preferences of females tend to be more conservative than those of males in general, this may not be entirely true in the case of MPF female scheme members in Hong Kong. In general, investment of female scheme members is only slightly more conservative than their male peers. In fact, their investment preferences tend to be growth-oriented. For example, more than three quarters of MPF of females are invested in growth funds (equity funds and mixed assets funds), which is similar to that of male scheme members.

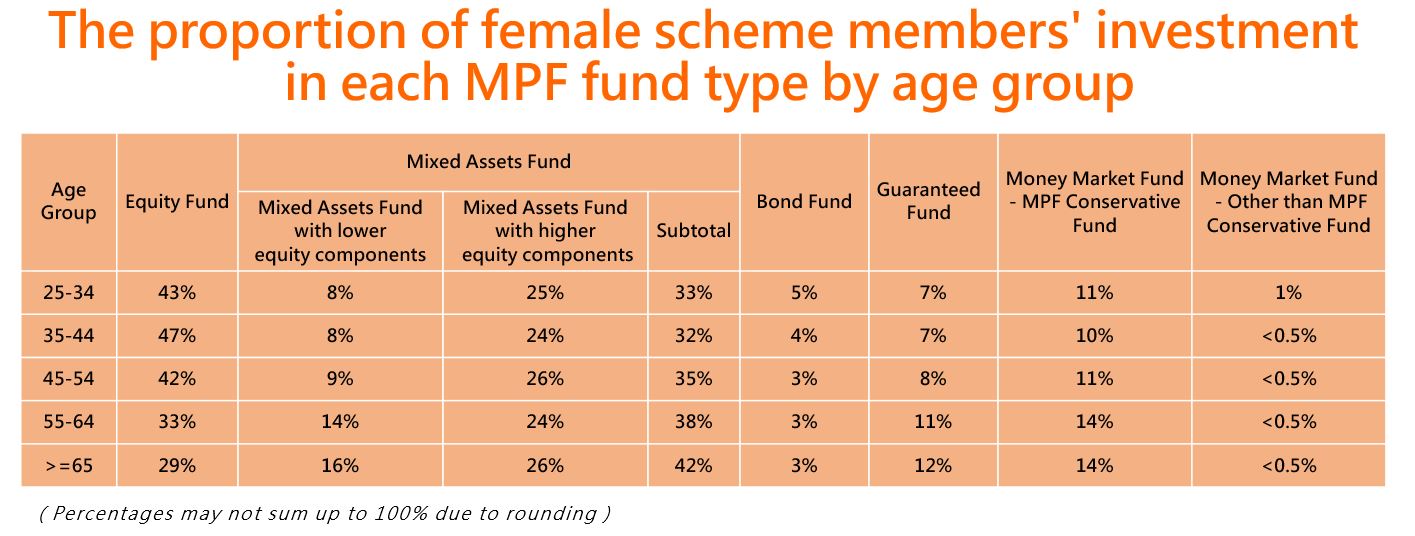

MPFA figures show that female scheme members possess an awareness of de-risking according to age. For example, the proportion of their investment in equity funds decreases from 43% in the age group of 25 to 34 to 33% in the age group of 55 to 64. Part of the proportion of their investment in equity funds is shifted to MPF conservative funds and guaranteed funds which are relatively less risky. The proportions of investment in these two fund types increases from 11% to 14% and from 7% to 11% respectively. Moreover, part of the proportion of investment in equity funds is also shifted to mixed assets funds. In the case of mixed assets funds, the proportion of investment in mixed assets funds with lower equity components, i.e. fund types with relatively lower risk, also increases with the age of female scheme members.

Mrs Lau pointed out that DIS is a convenient ready-made solution for women who have no time or lack investment knowledge to manage their MPF. Given the value for money offered by its features of fee caps, automatic de-risking and global mixed asset investment for risk diversification, DIS can help them manage their MPF more easily.

For the full version of the article, please visit the MPFA blog. The blog is in Chinese only.

MPFA Chairman Mrs Ayesha Macpherson Lau celebrates “International Women’s Day” with a group of women from Sham Shui Po.

-Ends-

7 March 2024

1. The related estimation of the MPF is a future value, which does not reflect the impact of inflation. The example is for illustration only and does not imply the actual value of the MPF generated by making TVC.

2. Towards Improved Retirement Savings Outcomes for Women”, 2021