- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - Another major reform – implementation of “full portability” of MPF benefits

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - Another major reform – implementation of “full portability” of MPF benefits

Mrs Ayesha Macpherson Lau, MPFA Chairman, published her blog post today (27 October), expressing her gratitude and great honour for the opportunity to participate in another significant breakthrough in the MPF’s continual reforms, namely the announcement of the implementation of “full portability” of MPF benefits in the Chief Executive’s 2024 Policy Address, with the MPFA being tasked to work out the implementation details. She stated that “full portability” of MPF benefits would allow employees to transfer the accrued benefits derived from employer mandatory contributions to a scheme of their choice. This will enhance the autonomy of the working population in MPF management, invigorate competition in the MPF market, and as a result provide the working population with better retirement protection.

Mrs Lau mentioned in the blog post that the MPFA has all along strived to enhance the autonomy of scheme members. The Employees Choice Arrangement, commonly known as MPF “semi-portability”, aims to help the working population actively manage their MPF by allowing them to transfer the accrued benefits derived from employee mandatory contributions for their current job once a year, in one lump sum, to a scheme of their choice. It will reach its 12th anniversary in November.

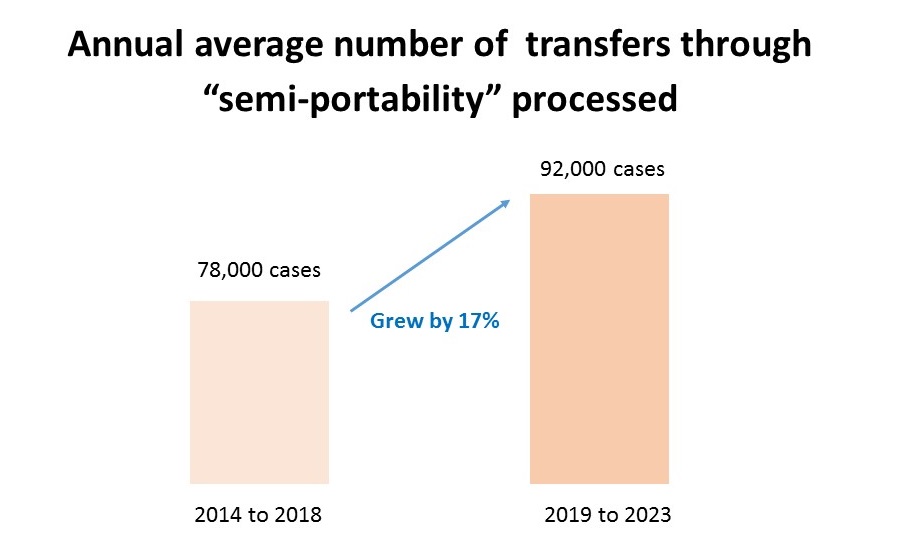

The annual average number of MPF transfers through “semi-portability” processed in the past five years (from 2019 to 2023) amounted to 92,000, reflecting an increase of 17% from that of the previous five years (from 2014 to 2018). This indicates that more and more scheme members are actively managing their MPF. As of September this year, the accumulated number of transfers processed approached one million, and the amount of funds involved exceeded $48 billion.

With the Government’s announcement of the abolition of the “offsetting” arrangement from 1 May next year for employees who commence employment on or after that day (the transition date), their employers can no longer use the accrued benefits derived from employer mandatory contributions to offset SP/LSP. This will eliminate a major obstacle to the implementation of “full portability” of MPF benefits.

Furthermore, the eMPF Platform (the eMPF), which came into operation in June this year, will be fully operational by the end of next year, making the implementation of “full portability” of MPF benefits more cost-effective. Therefore, the abolition of the MPF “offsetting” arrangement, together with the full operation of the eMPF, will be a crucial foundation for the implementation of “full portability” of MPF benefits.

Mrs Lau explained the merits of“full portability” of MPF benefits for the working population using an example of a fresh graduate entering the workforce in July 2026. As the MPF “offsetting” arrangement will no longer be applicable by then, mandatory contributions made by both the employer and the employee in the MPF account for the current job can be covered by “full portability” and transferred to the scheme member’s preferred MPF scheme. As regards the working population already in the job market, if they switch jobs in the future, the mandatory contributions for the new job will not be subject to the “offsetting” arrangement, allowing for “full portability” of such MPF benefits. The MPFA anticipates that when “full portability” is implemented, the proportion of mandatory contributions accrued from current employment that can be transferred will gradually increase from approximately 50% at present to 100%.

Abiding by the vision “MPF of the People, for the People”, the MPFA is committed to fully supporting the Government to work out the implementation details, conduct public consultations, effect legislative amendments, and carry out related promotional and educational activities, with a view to launching “full portability” of MPF benefits as soon as possible after the eMPF is fully operational.

For the full version of the post, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

27 October 2024