- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - Promoting MPF full portability

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - Promoting MPF full portability

MPFA Chairman Mrs Ayesha Macpherson Lau published her blog post today (21 April), providing an update on the ongoing consultation on MPF full portability, which began on 28 March. She said the responses received included recognition that the two proposals presented in the consultation paper would meet the expectations of both existing employees and employees who commence employment on or after the effective date for the abolition of the MPF offsetting arrangement (1 May 2025) of greater autonomy in managing their MPF. The feedback also included suggestions that the MPFA continue to explain the specific details of the arrangement for MPF full portability before its implementation.

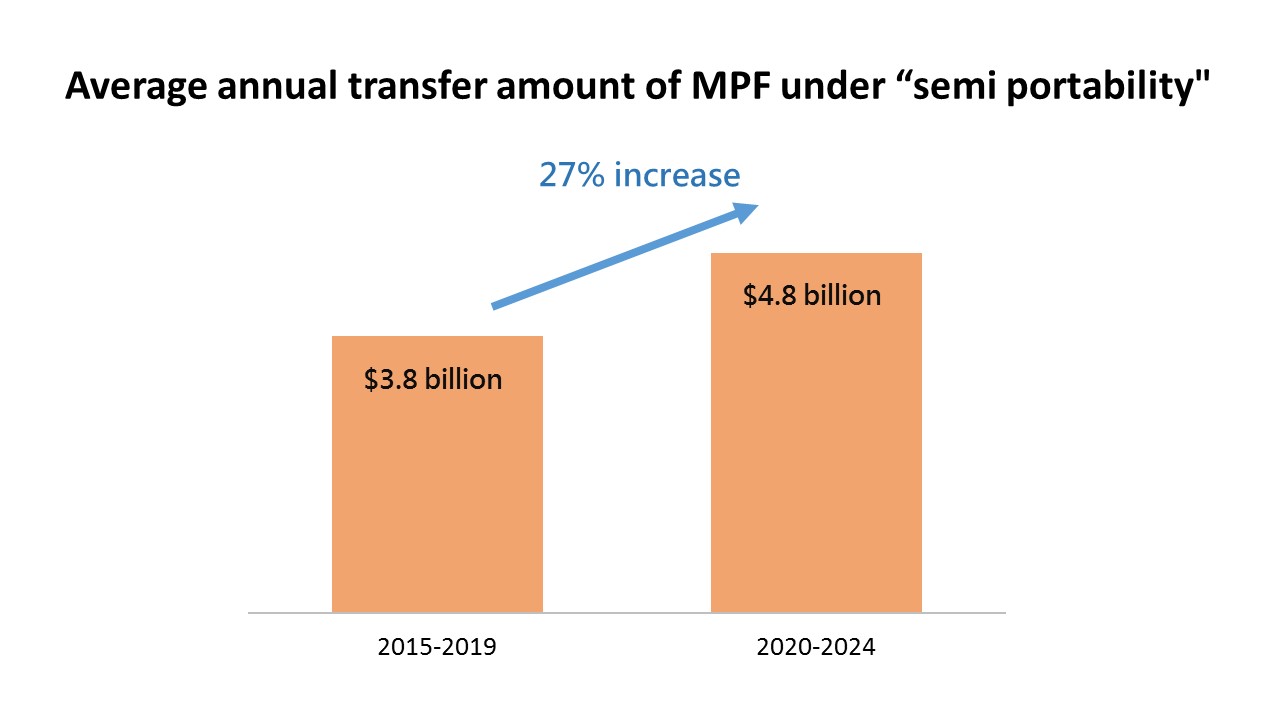

Mrs Lau pointed out that after the Employee Choice Arrangement, commonly known as “semi-portability”, was introduced in 2012, employees could transfer the entire amount of their employee mandatory contributions (EEMC) in their contribution accounts from the MPF schemes of their employers to a scheme of their choice once a year, thereby enabling them to select an MPF scheme that better suits their investment needs. During the five-year period from 2020 to 2024, on average, $4.8 billion a year in MPF was transferred through “semi-portability” to schemes chosen by employees, representing a 27% increase from an annual average of $3.8 billion in the previous five-year period from 2015 to 2019. As of March 2025, the cumulative number of transfers through “semi-portability” exceeded 1 million, involving a total amount of over $50 billion.

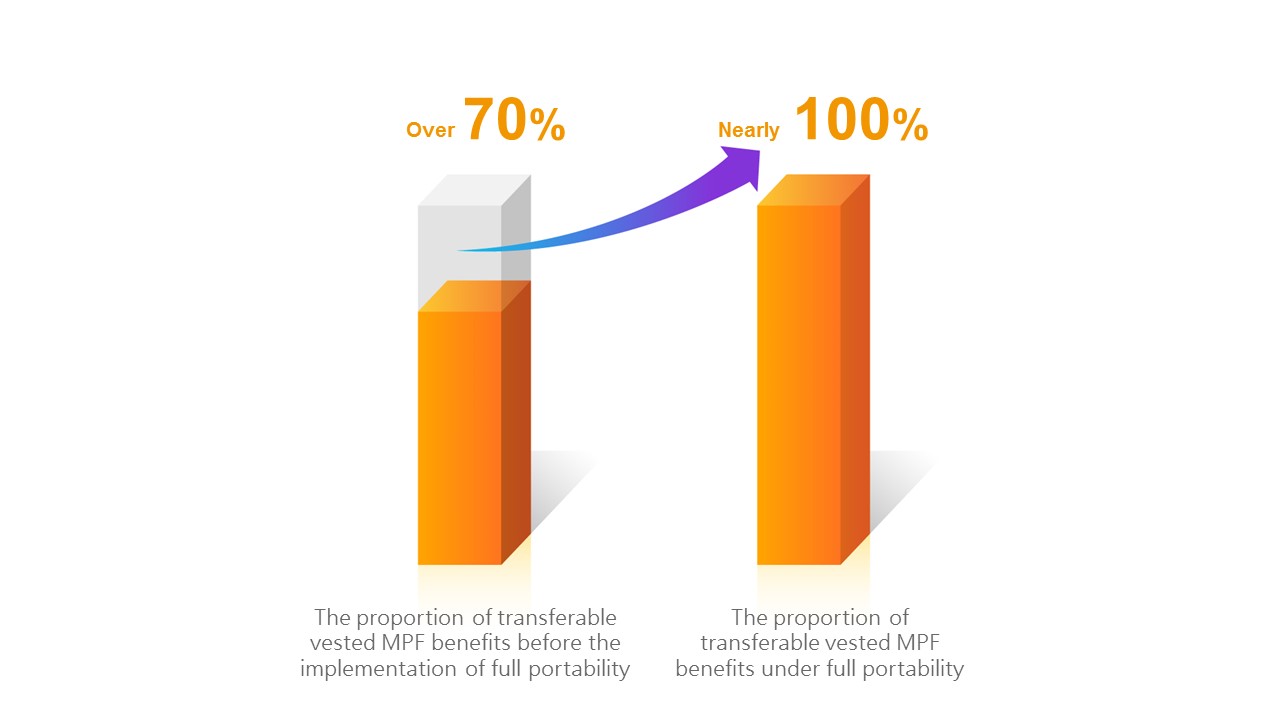

These figures indicate that many employees are familiar with “semi-portability” and are actively utilizing this arrangement to manage their MPF. Full portability builds on this foundation and leverages the opportunities provided by the eMPF Platform, with a view to expanding the transferable portion of MPF accrued during current employment from covering only EEMC to all mandatory contributions (i.e. also including employer mandatory contributions (ERMC)). Within the vested MPF benefits for employees, the proportion of transferable MPF will increase from over 70% to nearly 100%.

Mrs Lau added that under the full portability proposals put forward in the current consultation, existing employees who commenced employment before the abolition of the MPF offsetting arrangement and new employees or job-switchers who start employment afterward can both transfer the entire amount of their ERMC once a year to a “designated ERMC Account” (a new account type to be introduced) or to a personal account for further investment and growth in an MPF scheme of their choice.

She encouraged interested parties to visit the MPFA website (https://www.mpfa.org.hk/en/info-centre/consultations-and-conclusions/open) and share their views on the proposals for MPF full portability .

For the full version of the article, please visit the MPFA blog. The blog is available in Chinese only.

-Ends-

21 April 2025