- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- Public Consultation on “Core Fund” launched - Providing Better Investment Solutions for MPF Members

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

Public Consultation on “Core Fund” launched - Providing Better Investment Solutions for MPF Members

The Government and the Mandatory Provident Fund Schemes Authority (MPFA) today (24 June) launched a public consultation on the proposal to enhance the regulation of default arrangements in MPF schemes by introducing a “core fund” as the standardized low fee default fund of all MPF schemes.

Key features of the proposed “core fund” are that:

Key features of the proposed “core fund” are that:

- it should automatically reduce investment risk as members approach retirement age; and

- its fee will be kept at 0.75% of fund assets or under.

Professor K C Chan, Secretary for Financial Services and the Treasury, said, “The MPF System is an important part of Hong Kong’s retirement protection system. To address concerns over ‘high fees’ and ‘difficulty in making choices’, the Government and the MPFA will implement reform measures and introduce legislation to provide scheme members as soon as possible with a low fee ‘core fund’ that is consistent with the philosophy of retirement protection.”

“At the same time, we hope the core fund will become a benchmark, enhancing competition among funds and ultimately driving the overall MPF fee level down,” he said.

“Depending on the outcome of the consultation, the Government and the MPFA will follow up on the legislative and implementation issues in full gear. We aim to launch the ‘core fund’ in 2016,” he added.

Chairman of the MPFA Ms Anna Wu said, “This initiative aims to address two major concerns of scheme members, namely not knowing how to select funds and high fees.”

Under the MPF System, scheme members have the right to make their own investment choices by selecting funds. For those who do not select funds, the trustees of the respective schemes will, by default, invest the scheme members’ contributions in one or more of the funds as specified in scheme rules.

At present, different MPF schemes have different default arrangements and their risk and investment outcomes differ significantly.

Ms Wu said the MPFA had looked at overseas pension systems and saw good reasons to step up regulation of the default arrangements to better protect scheme members who did not make a fund choice.

“The ‘core fund’ will adopt a life cycle or target date investment strategy that automatically reduces investment risks as scheme members approach retirement age. It should also be subject to fee controls.”

By adopting a life cycle or target date investment approach, the “core fund” will best manage the long-term risks associated with investing retirement savings for up to 40 years which exposes those savings to multiple investment and market cycles.

Ms Wu pointed out that the “core fund” will be not just for those who do not make a fund choice. It will be available to all scheme members if they think the investment strategy and the fee level of the “core fund” suit their investment objectives.

She added that by being the standardized default fund, the “core fund” will become a benchmark in MPF fees and performance, facilitating comparisons among funds by scheme members, driving competition and therefore forcing fees down.

Meanwhile, the MPFA will further consult the industry and other relevant stakeholders on the technical details and the best option to implement the “core fund”.

Ms Wu said the MPFA hoped a concrete proposal for the “core fund” will be presented to the Government in late 2014 or early 2015.

Ms Wu said, “The MPFA is committed to refining the MPF System and we are prepared to take bold new measures to improve retirement protection for scheme members. Setting a fee target is something we have not done before, and the level proposed is an ambitious target.

The three-month public consultation will end on 30 September 2014. The consultation paper can be downloaded from the websites of the MPFA and the Government, and can be obtained at various places. For enquiries, please call the MPFA Hotline on 2918 0102.

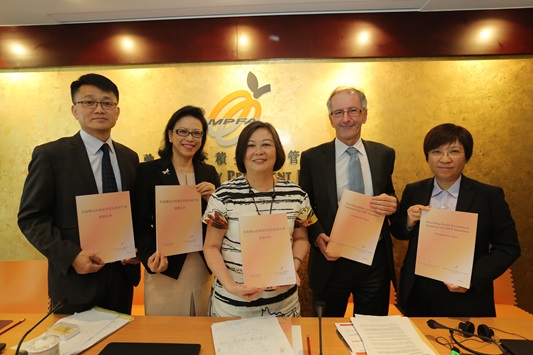

Mandatory Provident Fund Schemes Authority Chairman Anna Wu (Centre), Managing Director Diana Chan (second from left), Chief Regulation & Policy Officer Darren McShane (second from right), Chief Corporate Affairs Officer Cheng Yan-chee (first from left) and Head (Investment Regulation) Stella Yiu (first from right) introduce the consultation paper on “core fund”.

24 June 2014

“At the same time, we hope the core fund will become a benchmark, enhancing competition among funds and ultimately driving the overall MPF fee level down,” he said.

“Depending on the outcome of the consultation, the Government and the MPFA will follow up on the legislative and implementation issues in full gear. We aim to launch the ‘core fund’ in 2016,” he added.

Chairman of the MPFA Ms Anna Wu said, “This initiative aims to address two major concerns of scheme members, namely not knowing how to select funds and high fees.”

Under the MPF System, scheme members have the right to make their own investment choices by selecting funds. For those who do not select funds, the trustees of the respective schemes will, by default, invest the scheme members’ contributions in one or more of the funds as specified in scheme rules.

At present, different MPF schemes have different default arrangements and their risk and investment outcomes differ significantly.

Ms Wu said the MPFA had looked at overseas pension systems and saw good reasons to step up regulation of the default arrangements to better protect scheme members who did not make a fund choice.

“The ‘core fund’ will adopt a life cycle or target date investment strategy that automatically reduces investment risks as scheme members approach retirement age. It should also be subject to fee controls.”

By adopting a life cycle or target date investment approach, the “core fund” will best manage the long-term risks associated with investing retirement savings for up to 40 years which exposes those savings to multiple investment and market cycles.

Ms Wu pointed out that the “core fund” will be not just for those who do not make a fund choice. It will be available to all scheme members if they think the investment strategy and the fee level of the “core fund” suit their investment objectives.

She added that by being the standardized default fund, the “core fund” will become a benchmark in MPF fees and performance, facilitating comparisons among funds by scheme members, driving competition and therefore forcing fees down.

Meanwhile, the MPFA will further consult the industry and other relevant stakeholders on the technical details and the best option to implement the “core fund”.

Ms Wu said the MPFA hoped a concrete proposal for the “core fund” will be presented to the Government in late 2014 or early 2015.

Ms Wu said, “The MPFA is committed to refining the MPF System and we are prepared to take bold new measures to improve retirement protection for scheme members. Setting a fee target is something we have not done before, and the level proposed is an ambitious target.

The three-month public consultation will end on 30 September 2014. The consultation paper can be downloaded from the websites of the MPFA and the Government, and can be obtained at various places. For enquiries, please call the MPFA Hotline on 2918 0102.

Mandatory Provident Fund Schemes Authority Chairman Anna Wu (Centre), Managing Director Diana Chan (second from left), Chief Regulation & Policy Officer Darren McShane (second from right), Chief Corporate Affairs Officer Cheng Yan-chee (first from left) and Head (Investment Regulation) Stella Yiu (first from right) introduce the consultation paper on “core fund”.

24 June 2014