- MPFA

-

MPF System

- Background

- Types of MPF Schemes

- MPF Coverage

- Enrolment and Termination

- Mandatory Contributions

- Voluntary Contributions / Tax Deductible Voluntary Contributions

- MPF Tax Matters

- MPF Account Management

- Withdrawal of MPF

- Arrangements for Offsetting Long Service Payment and Severance Payment

- Anniversaries of MPF System

- MPF Investment

- ORSO

- Supervision

- Enforcement

- eMPF Platform

Info Center

Press Releases

- Your Position

- Homepage

- Information Centre

- Press Releases

- MPFA blog - MPF achieved favourable performance in 2024

Share

-

Facebook

-

LinkedIn

-

WhatsApp

-

Email

-

Copy Address

URL copied! -

Print This Page

MPFA blog - MPF achieved favourable performance in 2024

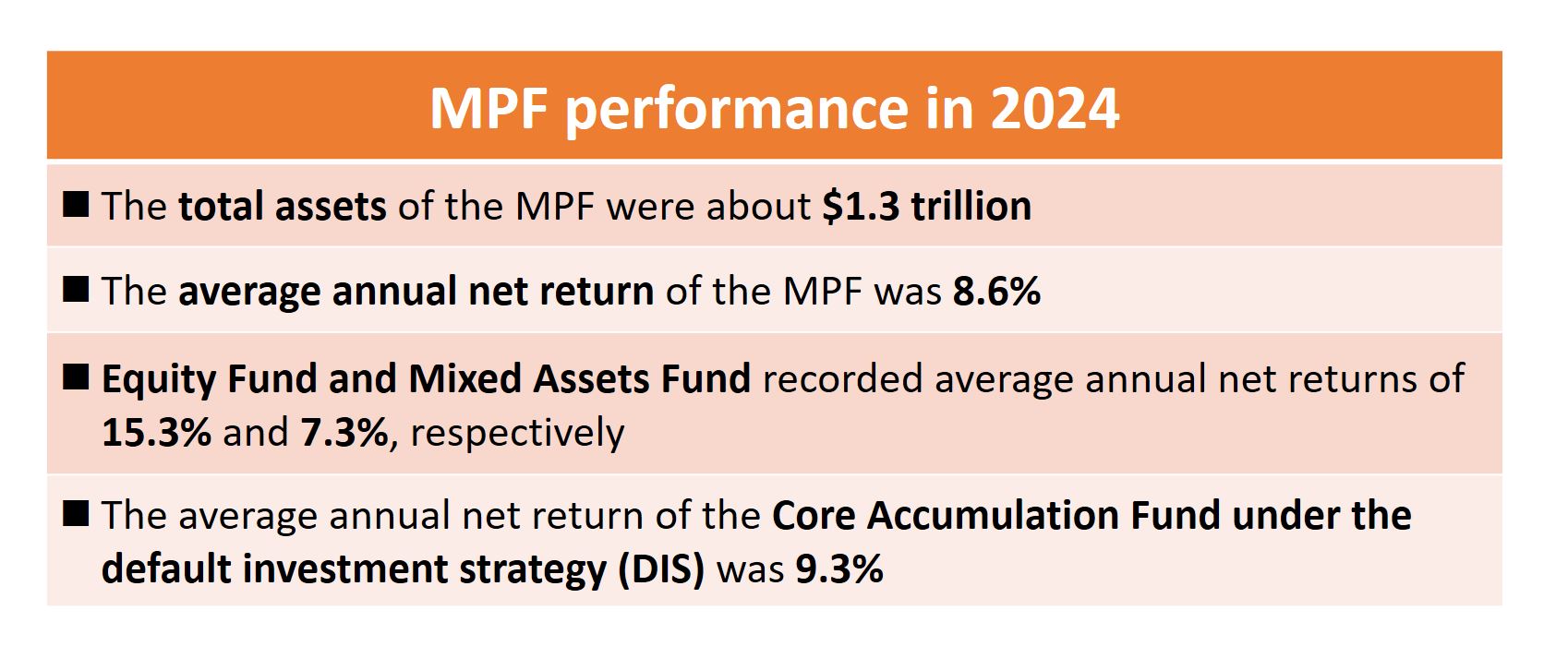

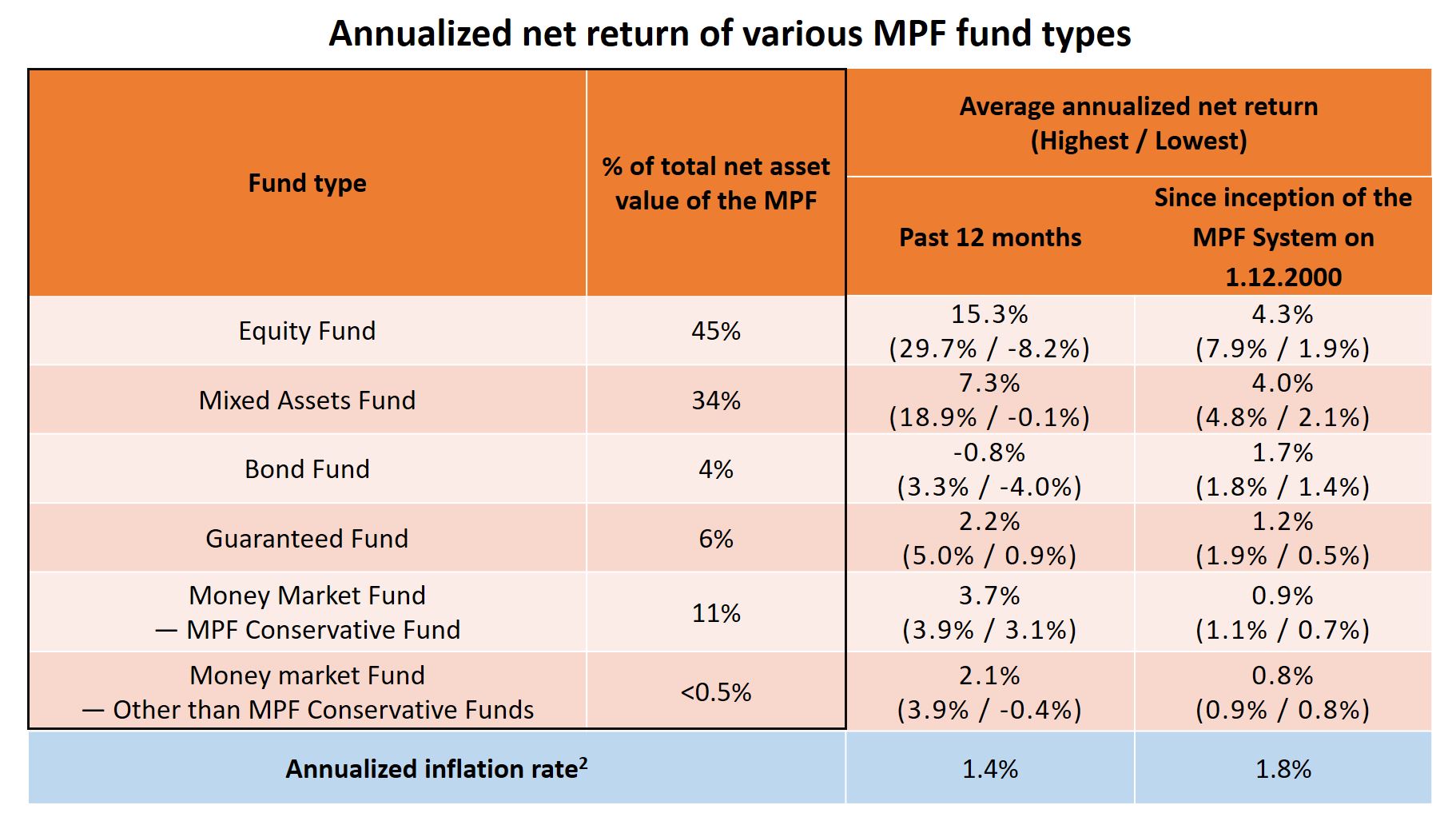

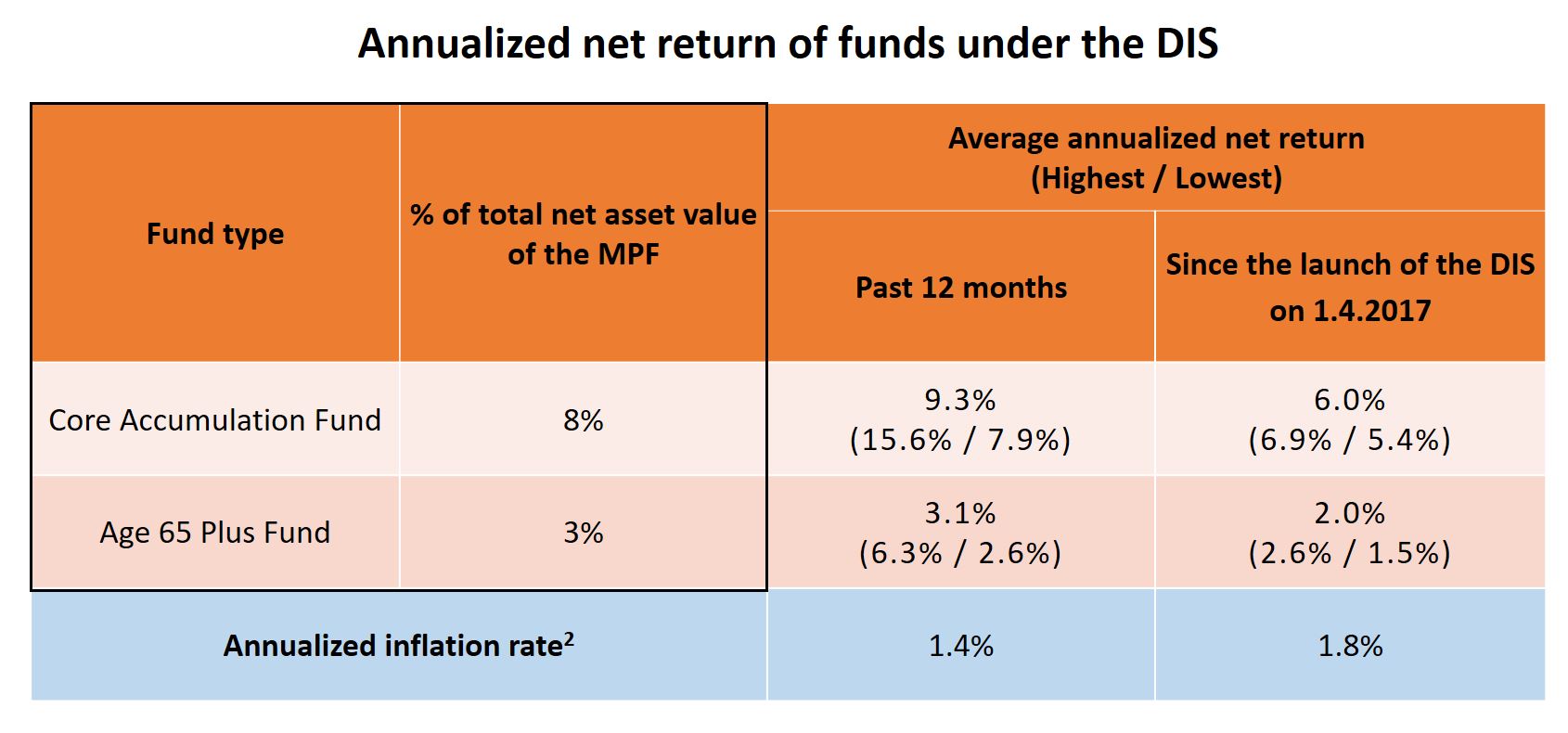

MPFA Chairman Mrs Ayesha Macpherson Lau published her blog post today (12 January). She noted that various commercial institutions had recently published their respective estimations on MPF investment returns, leading a confusing array of information. She highlighted that according to the official statistical data collected from MPF trustees and verified by the MPFA, the total net asset value of the MPF System had already increased to close to $1.3 trillion as at the end of 2024. The overall investment performance of the MPF in 2024 was good, achieving an average annual net return of 8.6%1.

Mrs Lau emphasised that the overall average net return of the MPF is a generalized statistic and that the average, highest and lowest figures of each fund type also serve only as references. They are not directly correlated with the investment returns of individual scheme members because scheme members select their own MPF investment portfolio according to their personal investment goals. The risk level and performance of the market in which the funds are invested vary, resulting in different returns.

She reminded scheme members not only to consider the past year’s performance of overall MPF investments, but also to review their personal MPF information, including the MPF Annual Benefit Statement and Fund Fact Sheet issued by their trustees, to understand the investment performance of funds that are relevant to them. She also suggested that they use the MPFA’s MPF Fund Platform to understand the investment objectives, risk levels, fund expense ratios, performance and other related information of individual funds under different timespans. They should assess and adjust their MPF investment portfolio and make due preparation for the new year with reference to factors such as their life stage, financial situation and risk tolerance level.

She also noted that some commercial agencies release short-term MPF performance figures every month. In fact, the MPF is a long-term investment, spanning over 40 years. Short-term data do not have much reference value for long-term investment planning. It may even mislead scheme members into viewing the MPF from a short-term speculative perspective, thereby compromising the proper management of their MPF, leading them “buying high and selling low” and incurring unnecessary losses.

She also reminded scheme members that although the overall performance of MPF last year was favourable, attempts to predict the future market trend would prove to be futile. Therefore, it is important for scheme members to focus on diversifying their MPF investments to mitigate the potential risks and impacts amidst market volatility.

To enable MPF trustees and the fund industry to provide better and more diversified investment options for the working population to strive for better investment returns and diversification of risks, the MPFA has continually reviewed and refined the regulation of MPF investments, and further expanded the scope of permissible asset classes. For example, in view of the role of listed real estate investment trusts (REIT) in diversifying investments and providing stable income, the MPFA completed a review last year and made plans to allow MPF investments in REIT listed on the Shenzhen Stock Exchange and Shanghai Stock Exchange, while lifting the investment limits for REIT that are listed on approved exchanges in five markets: Singapore, Japan, Canada, France and the Netherlands. Once the detailed arrangements and schedule for the inclusion of REIT in “Shanghai-Hong Kong Stock Connect” are confirmed, the MPFA will implement the plan expeditiously.

In addition, the MPFA continues to encourage MPF funds to utilize lower-cost index tracking-collective investment schemes (ITCIS) to further reduce fees and benefit the working population. As of September 2024, MPF funds invested in ITCIS reached $220 billion, accounting for over 16% of the total net asset value of the MPF.

For the full version of the post, please visit the MPFA blog. The blog is in Chinese only.

-Ends-

12 January 2025

1. The net returns in this release are data as at the end of December 2024.

2. Based on the latest (November 2024) Consumer Price Index.